The reverse split is intended to bring the company back into compliance with Nasdaq’s $1 minimum bid price rule.

- The company announced a 1-for-25 reverse stock split.

- The split takes effect Thursday, with split-adjusted trading Friday, reducing outstanding shares to about 1.1 million from 27.8 million.

- The move comes amid continued progress on AD04, with Phase 3 planning completed.

Shares of Adial Pharmaceuticals Inc. cratered over 20% in after-hours trading on Tuesday after the company announced a 1-for-25 reverse stock split to restore compliance with Nasdaq’s minimum bid price requirement.

ADIL Reverse Stock Split

Adial said the reverse split will take effect Thursday, with the stock set to begin trading on a split-adjusted basis on Friday. This will reduce outstanding common shares to nearly 1.1 million from about 27.8 million, while shareholder ownership percentages will remain unchanged, apart from the treatment of fractional shares. The company added that proportional adjustments will be made to outstanding equity awards and warrants, including exercise prices.

Adial said the reverse split is intended to bring the company back into compliance with Nasdaq’s $1 minimum bid price rule, a requirement for maintaining its listing.

AD04 Development In Focus

The reverse split comes as Adial continues to advance AD04, its genetically targeted serotonin-3 receptor antagonist for the treatment of Alcohol Use Disorder, with a focus on heavy drinking patients and select genotypes.

The company has advanced Phase 3 trial design and planning, drawing on analyses of historical clinical data that identified genotype-defined subgroups more likely to benefit from the therapy.

On the regulatory front, Adial completed its End-of-Phase-2 discussions with the U.S. Food and Drug Administration (FDA), saying the agency provided input on the Phase 3 adaptive trial design and the broader clinical program. The company said the discussions covered key elements such as patient population, endpoints, dosing, and confirmation of biomarker-positive and biomarker-negative groups, including a focus on the AG+ genotype, and were later formalized through final FDA meeting minutes.

Adial has also worked to strengthen intellectual property protection for AD04, saying an international patent application covering the program has been published and, if granted, is expected to protect its core assets through at least 2045.

How Did Stocktwits Users React?

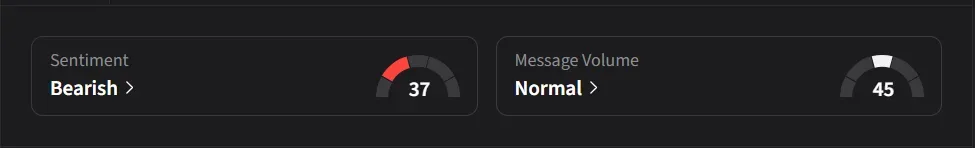

On Stocktwits, retail sentiment was ‘bearish’ amid ‘normal’ message volume.

One user said the market reaction appeared overly short-term focused, adding that near-term share price moves mattered less to them, as they viewed Adial as a “long-term story” and said the company’s underlying clinical progress has been moving well.

Another user said, “more dilution will follow after min price bid met. It will be voted on at end of the month. This will likely be below $1 again by March.”

ADIL’s stock has declined 75% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<