Novo leads early in oral obesity drugs, while Lilly counters with a strong injectable franchise and an oral pill nearing approval.

- Novo Nordisk cut its 2026 outlook after missing 2025 estimates, while Eli Lilly heads into earnings with a focus on Medicare tailwinds and its oral obesity pill.

- Analysts favor Lilly over Novo on upside and ratings, despite strong early uptake of Novo’s oral Wegovy pill.

- Novo is down nearly 40% over the past year, and Lilly is up about 25%.

Novo Nordisk has shaken investors with a downbeat outlook on Tuesday, and Eli Lilly is next up, setting the stage for a fresh comparison as earnings season tests which obesity-drug leader offers better upside.

Over the past 12 months, Novo Nordisk’s shares have shed nearly 40%, while Eli Lilly has gained about 25%.

Novo Guidance Cut Jolts Stock, Lilly Earnings In Focus

Novo shares plunged 15% on Tuesday after the company warned that fiscal 2026 adjusted sales could fall 5% to 13% and adjusted operating profit could decline by as much as 13%, citing pricing pressure, intensifying competition, and patent expiries for the active ingredient in Wegovy and Ozempic in some markets outside the U.S.

The outlook followed 2025 results that missed expectations. Novo reported net sales of DKK 309.06 billion ($48.9 billion), up 6% year over year but below estimates of DKK 346.97 billion. Diluted earnings per share (EPS) rose to DKK 23.03 but missed expectations of DKK 23.4, while operating profit slipped 1% to DKK 127.66 billion.

Meanwhile, Eli Lilly is expected to report quarterly revenue of $17.94 billion, up from $17.60 billion in the previous quarter, EBITDA of $8.43 billion, and GAAP EPS of $7.04, up from $6.21, even as EBIT is expected to edge lower, according to Koyfin analysts.

Wall Street Favors Eli Lilly Over Novo Nordisk

Wall Street currently favors Eli Lilly over Novo Nordisk, based on analyst targets and ratings. Novo Nordisk shares closed Tuesday at $50.3 in the U.S. and DKK 367.80 on the Copenhagen exchange. Koyfin data shows a 12-month average price target of DKK 401.91, implying about 9.3% upside from the last close. Analyst ratings on Novo include one ‘Strong Buy’, ten ‘Buy’, nine ‘Hold’, and two ‘Sell’ from 22 analysts.

Eli Lilly shares closed Tuesday at $1,003.46. Koyfin data shows a 12-month average price target of $1,150, implying about 14.6% upside from current levels. Analyst ratings on Lilly include four ‘Strong Buy’, 17 ‘Buy’, seven ‘Hold’, zero ‘Sell’, and one ‘Strong Sell’ from 29 analysts.

GLP-1 Pill Vs Injection Race

Novo currently holds a first-mover advantage in oral obesity drugs after the U.S. Food and Drug Administration (FDA) approved the Wegovy pill in December, and the company launched it last month. Reuters reported last month, citing IQVIA data shared by analysts, that the pill logged 18,410 U.S. prescriptions in its first full week, a stronger debut than Novo’s injectable Wegovy or Lilly’s Zepbound. Novo said this week that more than 170,000 patients have started the pill so far, with over 80% new to GLP-1 treatments.

Novo said earlier this week that its next-generation obesity drug CagriSema delivered greater weight loss and blood sugar reduction than Wegovy in a late-stage diabetes trial.

Lilly, meanwhile, has intensified competition in injectable weight-loss drugs, with UBS saying its tirzepatide-based treatment Zepbound is already established as a leading therapy in the class, increasing pressure on Novo’s Wegovy franchise. The company is awaiting FDA approval for its oral obesity drug Orforglipron, expected by April, with a full launch planned for the second quarter. Unlike Novo’s pill, Lilly’s oral drug does not require fasting, a feature UBS analysts flagged earlier this month as a potential competitive advantage.

Lilly continues to broaden its portfolio beyond obesity through acquisitions and partnerships, including the acquisition of Ventyx Biosciences, research collaborations with Seamless Therapeutics and Nimbus Therapeutics, and AI-focused partnerships with NVIDIA, Revvity, and Schrodinger.

NVO & LLY Face Policy Headwinds And Tailwinds

Novo said, alongside its earnings update on Tuesday, that lower realized prices, driven in part by U.S. government efforts to rein in drug costs, will weigh on near-term results, with Medicare discounts for Ozempic and Wegovy, announced last year, set to take effect in 2027.

Lilly’s management has struck a more optimistic tone. CEO Dave Ricks said last week that Medicare coverage for obesity drugs, expected to begin later this year, could expand access and lower out-of-pocket costs in the second half.

That optimism comes as the Centers for Medicare & Medicaid Services reported last week that the U.S. has proposed an average 0.09% increase in Medicare Advantage payments for 2027, resulting in more than $700 million in additional funding. Cantor Fitzgerald warned that the update could pressure healthcare insurers, citing limited incremental funding and greater political influence over rate-setting.

How Did Stocktwits Users React?

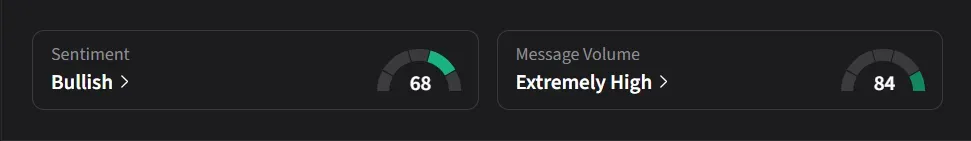

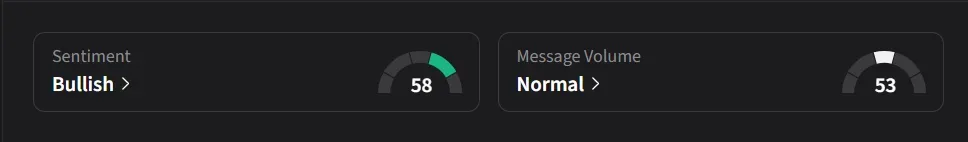

On Stocktwits, retail sentiment was ‘bullish’ for both stocks, with message volume ‘extremely high’ for Novo Nordisk and ‘normal’ for Eli Lilly. Novo message volumes surged nearly 2,900% over the past year, while Lilly message volumes more than doubled over the same period.

One user expects Novo Nordisk’s shares to rise if Eli Lilly’s results are disappointing.

Another user said they were concerned about Novo Nordisk’s outlook, warning that once Eli Lilly secures FDA approval for its oral obesity pill and gains traction, Novo’s shares could face further downside.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<