Meta is positioning artificial intelligence at the core of its business strategy following stronger-than-expected fourth-quarter results and outlining ambitious plans for 2026.

- In its earnings report, Alphabet said it expects to spend between $175 billion and $185 billion in 2026.

- Meta’s capital spending guidance is $115 billion to $135 billion.

- CEO Mark Zuckerberg said the company expects AI to profoundly change how it operates and serves users.

Meta Platforms Inc. (META) stock is in the spotlight on Thursday with Big Tech’s spending plans for 2026 coming into focus. On Wednesday, Google Parent Alphabet Inc. (GOOG, GOOGL) flagged a higher capital expenditure to build out artificial intelligence infrastructure – sharpening scrutiny of Meta’s capital plans.

In its earnings report, Alphabet said it expects to spend between $175 billion and $185 billion in 2026, a figure far higher than the $119.5 billion estimate and almost twice as much as it invested the year before.

This compares with Meta’s guidance of $115 billion to $135 billion.

What Are Stocktwits Users Saying

Meta stock inched 0.1% lower in Thursday’s premarket. The stock saw a 42% increase in retail messages over 24 hours and a 141% surge over the past 30 days.

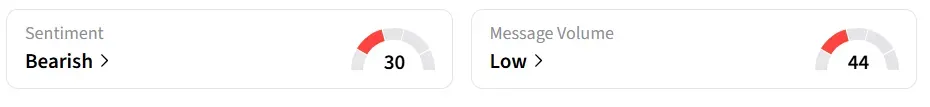

Retail sentiment around the stock turned to ‘bearish’ from ‘bullish’ territory the previous day. Message volume shifted to ‘low’ from ‘extremely high’ levels in 24 hours.

Meta’s Pivot To AI As Core Growth Engine

The parent company of Facebook, Instagram, and Threads is positioning artificial intelligence at the core of its business strategy after reporting stronger‑than‑expected fourth-quarter (Q4) results and outlining ambitious plans for 2026.

CEO Mark Zuckerberg said the company expects AI to profoundly change how it operates and serves users through improved products, machine learning‑driven personalization, and greater internal efficiency.

During a post‑earnings call, Zuckerberg described a “major AI acceleration” and said he sees 2026 as a pivotal period for investment and innovation. The sharply higher capex outlook from both companies reflects their intent to build long‑term technical capabilities and stay competitive with other major players in the AI arms race.

META stock has declined by 5% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<