XRP’s price fell more than 12% in the last 24 hours, making it the worst-performing major cryptocurrency during the session.

- The downtrend in XRP’s price occurred despite XRP spot ETFs recording inflows, bucking broader outflows from Bitcoin and Ethereum funds.

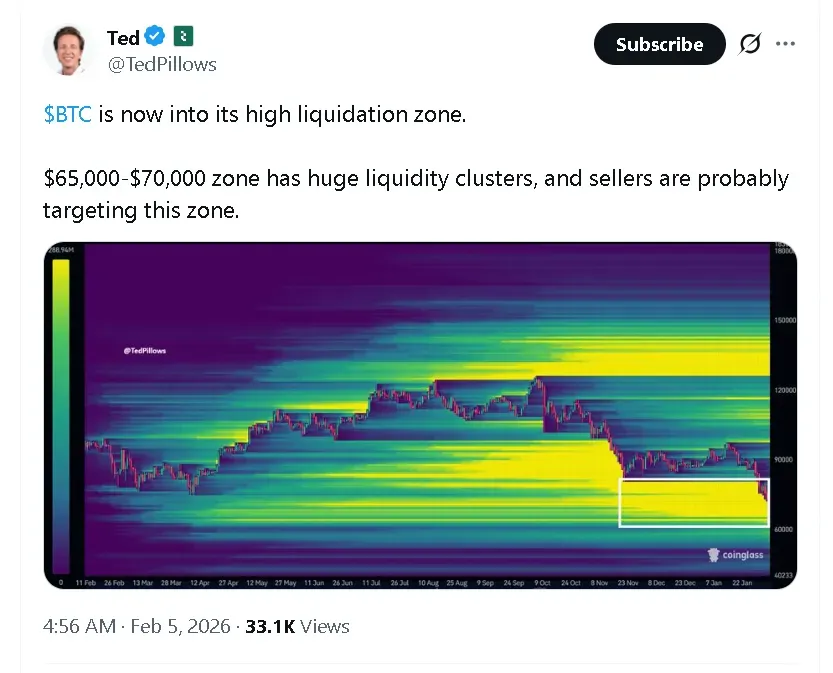

- Bitcoin’s price touched an intra-day low of just above $70,000 with analyst Ted Pillows flagging that BTC has now entered a “high liquidation” zone.

- According to CoinGlass data, Bitcoin's brief bout with $70,000 wiped out $886 million in leveraged bets over the past day.

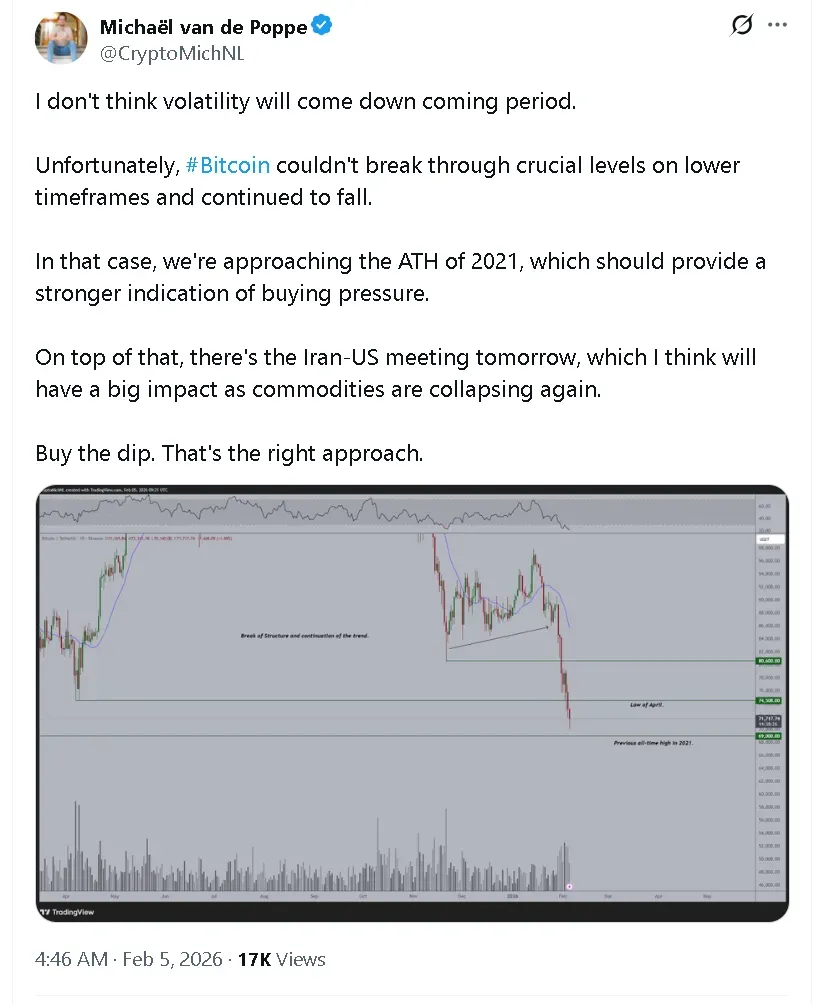

- MN Fund founder and chief investment officer Michael van de Poppe predicted that the outcome of the Iran-US meeting tomorrow may have a “big impact” on crypto prices.

Ripple’s XRP (XRP) led losses among major cryptocurrencies on Thursday morning, sliding more than 12% as Bitcoin (BTC) tested support near $70,000 and the broader crypto market struggled to hold above $2.5 trillion.

XRP’s price slid 12.2% in the last 24 hours to $1.40 while retail sentiment on Stocktwits around the altcoin fell further within ‘bearish’ territory over the past day, accompanied by chatter at ‘high’ levels.

One user on the platform said that XRP’s is likely to dip below $1 if the current downtrend continues.

Others were more optimistic, celebrating Evernorth’s upcoming initial public offering (IPO), which would make the company the largest XRP-backed digital asset treasury (DAT) with over 388 million tokens on its balance sheet.

XRP ETFs Buck Bitcoin, Ethereum Funds Outflow Trend

Despite the current downtrend, spot XRP ETFs were only crypto funds to see inflows on Wednesday. According to SoSoValue data, Bitcoin spot ETFs saw $545 million in outflows and Ethereum (ETH) spot ETFs saw $79 million in outflows. Meanwhile, XRP saw a total net inflow of $4.83 million in a single day. The Franklin XRP ETF (XRPZ) led the charge with $2.51 million of capital coming in.

US-Iran Meeting Could Catalyse Crypto Markets

XRP’s massive fall came after Bitcoin’s price fell 6.1% in the last 24 hours to around $71,500, recovering from an intra-day low that touched $70,000, as per CoinGecko data. On Stocktwits, retail sentiment around the apex cryptocurrency fell deeper into the ‘extremely bearish’ zone, accompanied by ‘extremely high’ levels of chatter.

According MN Fund founder and chief investment officer Michael van de Poppe, the outcome of the Iran-US meeting tomorrow may have a “big impact” on crypto prices, given that commodity prices are also in the doldrums.

Analyst Ted Pillows noted that Bitcoin has now entered a “high liquidation” zone between $65,000 and $70,000, meaning it’s trading in a price area where a lot of traders may be forced to sell their positions. According to CoinGlass data, Bitcoin’s brief bout with $70,000 wiped out $886 million in leveraged bets over the past day.

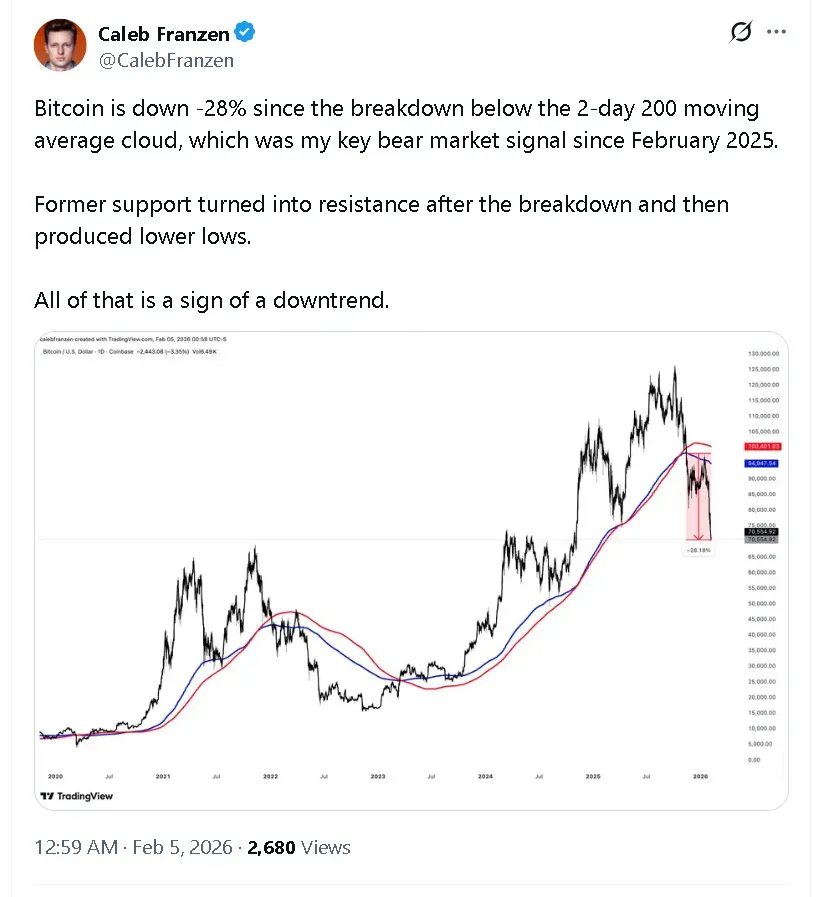

Technical analyst Caleb Franzen, said that there could be more pain to follow with Bitcoin down about 28% since it broke below the technical indicator of a 2-day 200 moving average.

Other tokens to underperform Bitcoin among the top 10 cryptocurrencies by market capitalization included Binance Coin (BNB) and Cardano (ADA), which fell more than 7% each. Dogecoin (DOGE) was down over 6% as well.

Ethereum’s price fell 5.5% while Solana (SOL) saw a dip of 4.9% and Tron (TRX) fell 2%.

Read also: Bitcoin Hits ‘End-Of-Winter’ Moment? Michael Burry, Mike Novogratz And Matt Hougan Are On The Same Page

For updates and corrections, email newsroom[at]stocktwits[dot]com.<