The company said affordability and predictable pricing drive demand, with its LillyDirect platform adding over 1 million users in 2025.

- Medicare rollout is expected by July 1, with 10%-20% of direct-to-patient users seen transitioning early.

- The company's 2026 outlook exceeded consensus, with revenue projected in the $80-$83 billion range and EPS of $33.5-$35.

- Zepbound vials make up about one-third of new patient starts.

Eli Lilly & Co. shares logged their best session in over nine months after the drugmaker posted a fourth-quarter (Q4) earnings beat and said a $50 monthly Medicare copay for anti-obesity medicines would be a “compelling value proposition,” with coverage expected no later than July 1.

The stock climbed to its highest level in a month, closing the regular session at $1,107.12, before paring gains to slip 0.5% in after-hours trading.

Eli Lilly Medicare Uptake

On the earnings call, CFO Lucas Montarce said 10% to 20% of patients currently using the company’s direct-to-patient channel could transition into Medicare relatively quickly once coverage begins, with additional growth expected to build over time.

CEO David Ricks said the company is working through implementation details with the U.S. administration and expects the program to expand access to anti-obesity treatments for seniors. He compared the initiative to earlier Part D savings programs, noting lower, more predictable out-of-pocket costs as a key driver of adoption.

Ricks added that the company’s expanding self-pay business remains difficult to model, saying there is “no good analog” in pharmaceuticals for this many patients paying out of pocket. He said the company is focused on reducing friction and expanding access as patients move across coverage channels.

Medicare Deal Expands Access At $50 Copay

The Medicare rollout follows an agreement between Lilly and the U.S. government in November to expand access to obesity medicines through Medicare and Medicaid. Under the deal, eligible patients would be able to access anti-obesity treatments for $50 per month out-of-pocket.

However, Montarce said pricing pressure in 2026 is expected to run in the low-to-mid teens, driven by the government access agreement, updated direct-to-patient Zepbound pricing, lower Medicaid prices for later-life-cycle products, and China reimbursement dynamics for Mounjaro. He added that higher volumes are expected to offset part of that impact over time.

LLY Q4 Results And 2026 Outlook

Lilly reported Q4 earnings per share of $7.54, beating estimates of $6.93, on revenue of $19.29 billion, above expectations of $17.94 billion. Full-year 2025 revenue rose 45% to $65.2 billion.

For 2026, the company expects revenue of $80 billion to $83 billion, above the consensus estimate of $77.56 billion, and forecasts earnings per share of $33.5 to $35, compared with a consensus of $33.3. It also expects a performance margin of 46%-47.5% and a tax rate of 18%-19%.

Lilly Sees Rising Self-Pay Use Of Zepbound Vials

The company said affordability and predictable pricing remain important drivers of demand, pointing to continued engagement on its LillyDirect platform, which added more than 1 million users in 2025.

Zepbound self-pay vials accounted for about one-third of new patient starts across branded obesity medicines. Vials represented roughly one-third of total Zepbound prescriptions and nearly 50% of new Zepbound prescriptions in Q4.

Lilly said Zepbound remains the branded obesity market leader, with nearly 70% share of new prescriptions, while Mounjaro finished the quarter with over 55% of new prescriptions in the U.S. type 2 diabetes incretin market.

On oral GLP-1s, the company said early data from a competitor’s launch appear to be “mainly expansion of the market,” rather than cannibalization. Lilly expects its oral obesity drug Orforglipron to launch in the U.S. in the second quarter of 2026, with limited international launches later in 2026 and broader rollouts in 2027.

Lilly also said its Alzheimer’s drug Kisunla has captured more than 50% of total prescriptions in the U.S. amyloid-targeting therapy market, citing improved diagnosis rates and adoption.

How Did Stocktwits Users React?

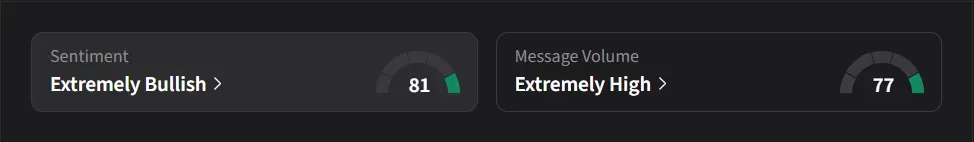

On Stocktwits, retail sentiment for Eli Lilly was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said Lilly “has been a Juggernaut for years. incredible run.”

Another user said, “$LLY is a monster. destroyed earnings and blasted through the $995 Fib level on 3x volume. The GLP-1 king is just getting started.”

Eli Lilly’s stock has risen 35% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<