Earnings beats, bargain hunting, and retail optimism sparked rebounds in extended trading

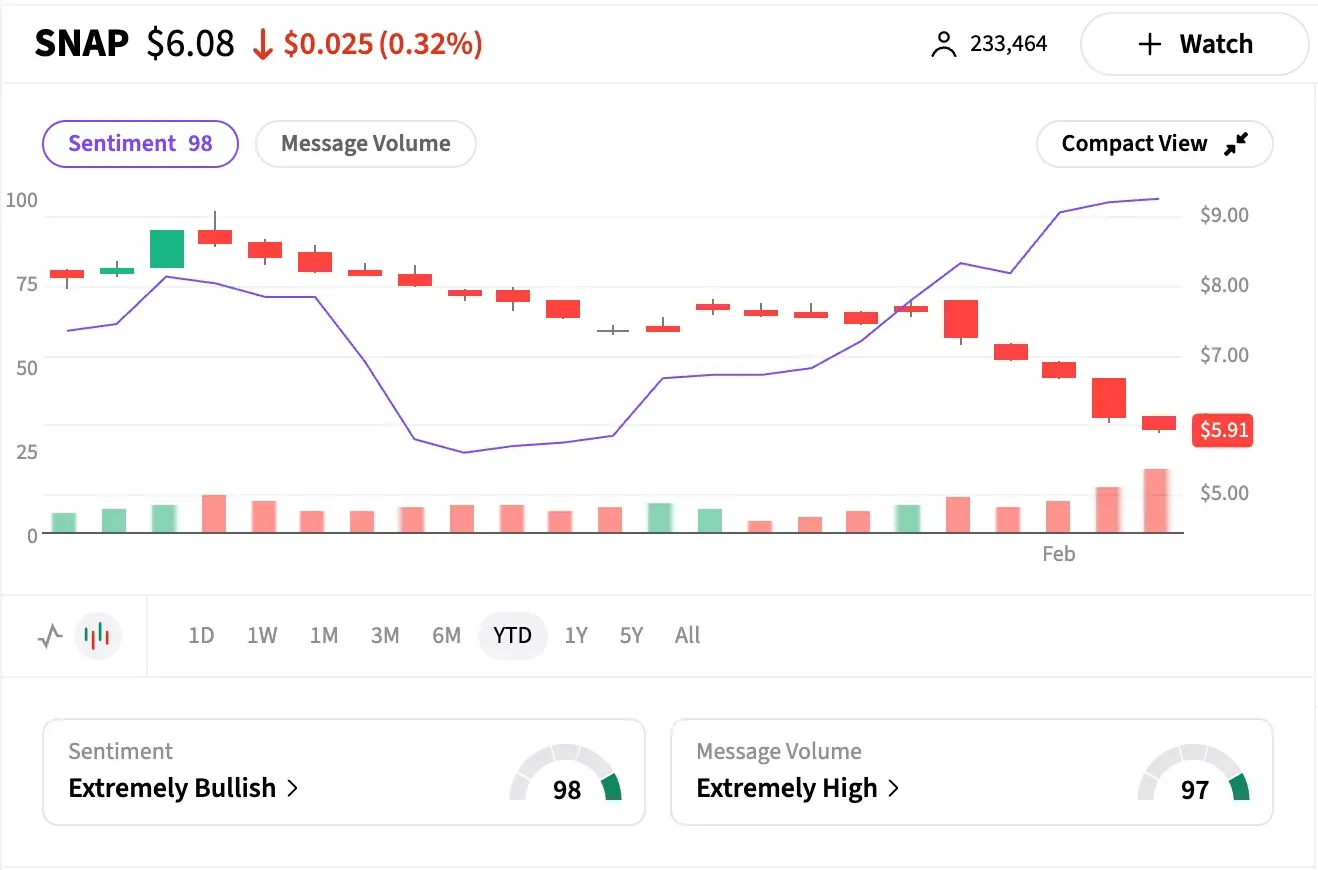

- Snap rebounded on a surprise earnings beat.

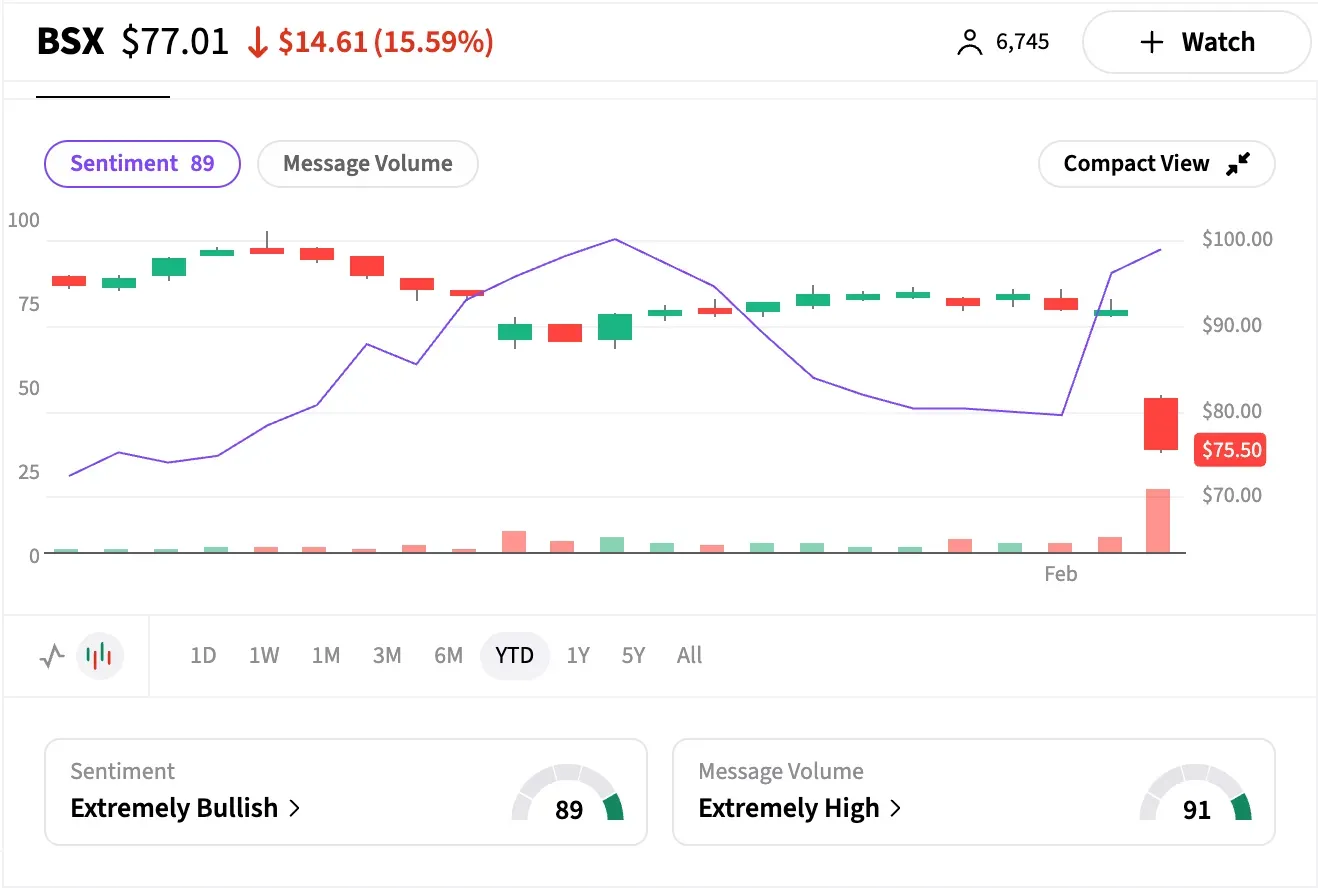

- Boton Scientific landed a price target cut, but investors largely remain confident in its long-term medtech pipeline despite some product stumbles.

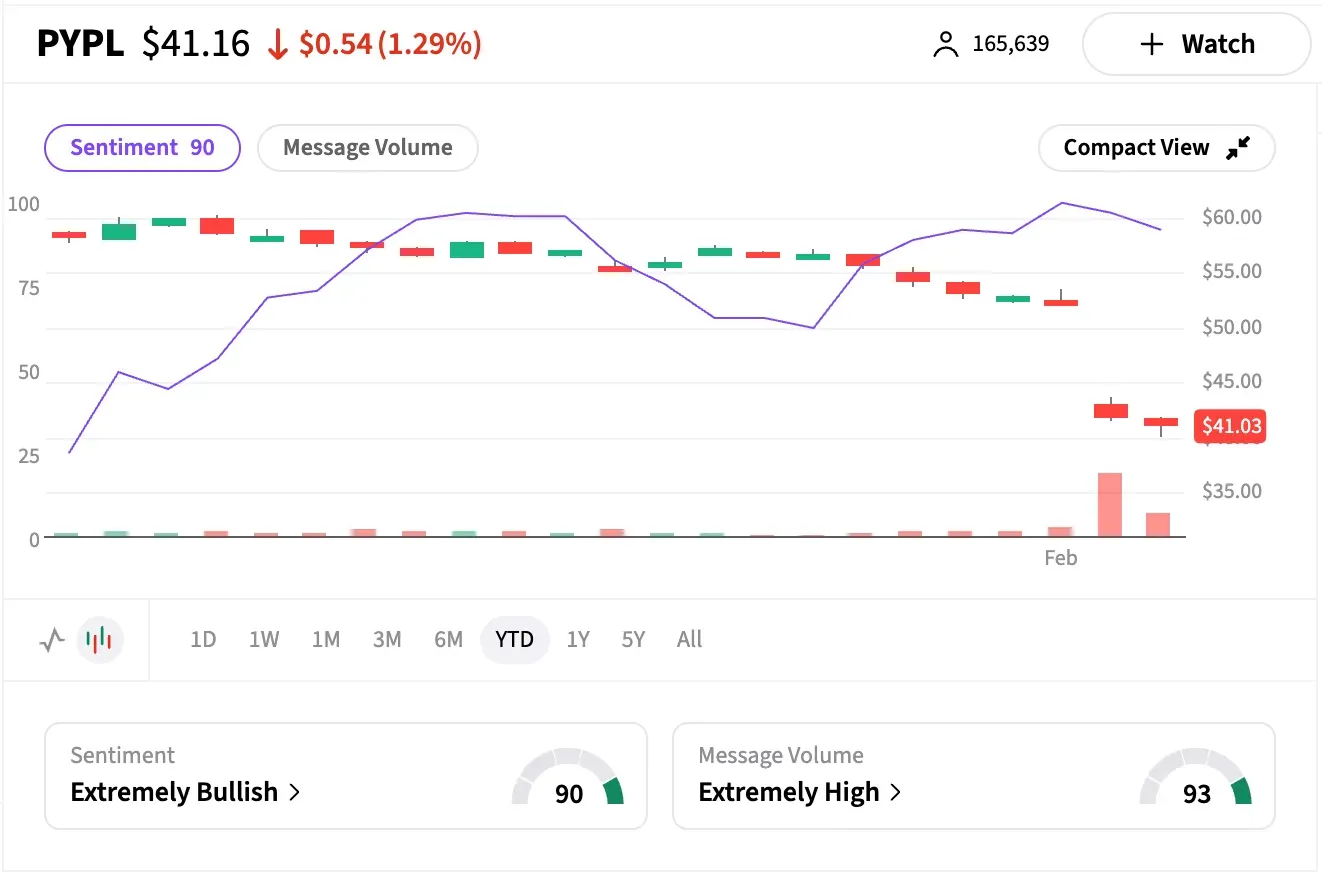

- PayPal still has retail conviction despite a slew of Wall Street downgrades after poor earnings and a CEO change.

Snap, Inc. (SNAP): The Snapchat parent's stock fell more than 3% during Wednesday's regular trading session, hitting a 52-week low of $5.86, amid a broader tech decline triggered by rising concerns over disruptions from new AI tools such as Anthropic.

However, Snap's stock rose by more than 2% in after-hours trading, with retail sentiment on Stocktwits turning even more 'extremely bullish', thanks to a surprise quarterly earnings beat and slightly higher-than-expected revenue, as more advertisers poured dollars into the platform during the holiday season.

SNAP is down over 28% this year.

Boston Scientific Corp. (BSX): The medical device maker's stock dipped to a new 52-week low of $75 during Wednesday's regular session, after BTIG cut its price target on BSX to $110 from $132, which still implies a more than 45% upside from the last close. The research firm said BSX fell by more than 15% on Wednesday after two key products — Farapulse and Watchman — missed Q4 sales expectations. The shortfall was most noticeable in the electrophysiology business, which came in $33 million below forecasts, reinforcing investor concerns that Boston Scientific may be losing market share in pulsed field ablation (PFA).

Despite this, BTIG still believes the company deserves a premium valuation because of its broad product lineup and strong pipeline. The stock rose over 2% in after-hours trading, with retail sentiment ending the day at 'extremely bullish' levels.

BSX has lost more than 21% this year.

PayPal Holdings Inc. (PYPL): Shares of the digital payments enabler closed down over 1.6% in Wednesday's regular session, with intraday levels hitting a new 52-week low of $39.96, as the market at large clearly disapproved of the latest quarterly results and the change of guard at the top. Rubbing salt into the wound, a rare public backlash from U.S. corporate executives lambasted PayPal for "destroying its product" and completely losing its way over the past few years.

The stock also received at least three downgrades on Wall Street, according to The Fly, but managed to climb 0.3% in after-hours trading with retail sentiment on Stocktwits holding onto 'extremely bullish' levels as of Wednesday's close.

PYPL has tumbled more than 30% in 2026.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<