Interop Labs staff and technologies will be integrated into Circle's blockchain ventures.

Circle's (CRCL) acquisition of Axelar developers caused concerns among crypto market watchers on Monday, with Axelar's native token (AXL) tanking over 16% following the announcement.

Circle (CRCL) announced that it would buy Interop Labs, the developers of the Axelar Network, as well as its intellectual property. Following the announcement, Axelar’s price tanked more than 16% in the last 24 hours to $0.1097.

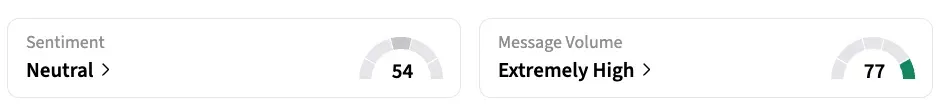

On Stocktwits, retail sentiment around AXL dropped from ‘bullish’ to ‘neutral’ territory over the past day, as chatter remained at ‘extremely high’ levels.

Token Versus Equity Debate

The news of Circle’s new acquisition seems to have sparked debate within the Axelar community, with some members on X referring to the selloff as a "token versus equity mismatch." With the token being excluded from the accusation, token holders believe that the value of the acquisition goes to the corporate entity rather than to token holders.

Others disputed that, while tokens represent a larger risk, they may benefit indirectly as network usage and adoption grow over time.

Circle’s Take On The Acquisition

Circle stated that the acquisition aims to integrate Interop Labs' cross-chain expertise with Circle's Cross-Chain Transfer Protocol (CCTP) and Arc blockchain. This would allow asset issuers to reach customers more effectively through speedier settlements and increased access to USDC liquidity.

Despite the agreement, Circle stated that the Axelar Network, Axelar Foundation, and AXL coin will continue to function independently and under community governance. However, Interop Labs' team and technology will be integrated into Circle's infrastructure-focused blockchain initiatives.

Get updates on this developing story directly on Stocktwits.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<