Big Tech is exploring space-based data centers to power AI, leveraging solar energy and scalability amid intensifying global limits, costs, and environmental constraints on terrestrial power.

- Hyperscalers and billionaires see space data centers as a solution to soaring AI-driven energy demand.

- Early experiments by Alphabet, Nvidia-backed Starcloud, and others are testing the feasibility of orbital computing.

- High launch costs, radiation hardening, cooling, and satellite networking remain significant hurdles.

Rising demand for data centers has pushed hyperscalers to explore unconventional, more energy-efficient options—moving beyond terrestrial facilities to underwater deployments, with the latest evolution being a push to establish data centers in space.

The concept of space-based data centers has struck a chord with billionaire entrepreneurs such as Elon Musk of SpaceX and Jeff Bezos, the founder of Blue Origin. Meanwhile, hyperscalers including Alphabet, Microsoft, and IBM have been exploring space-related computing and infrastructure initiatives—ranging from satellite-based data processing to orbital cloud services—as potential building blocks for future space-based data center models.

So, what exactly is this novel concept — and why has it captured the attention of companies?

Big Tech’s Next AI Power Play

Space data centers are a new frontier for computing that can sidestep the physical and environmental limitations of Earth-based data centers. By tapping into a continuous supply of solar power and operating in an unconstrained environment, they also offer the promise of far greater scalability.

The idea of space data centers gained ground this year as the energy demands of terrestrial data centers forced companies to look elsewhere. Nvidia-backed Starcloud, formerly called Lumen Orbit, launched Starcloud-1 into orbit in November, carrying Nvidia’s H100 AI processor. It is serving as an experiment for space-based computing.

Sundar Pichai-led Alphabet, Inc. announced “Project Suncatcher” in November. Calling it a moonshot project, Alphabet said it would launch two prototype satellites by early 2027.

“This experiment will test how our models and TPU hardware operate in space and validate the use of optical inter-satellite links for distributed ML tasks.”

Fellow megacap tech play Microsoft has yet to have a traditional large-scale data center in space. Still, it provides cloud services to space-based operations. It uses satellite connectivity for ground-based, remote data centers, such as its portable, shipping-container-sized Azure Modular Datacenters (MDC), powered by partners like SpaceX.

SpaceX owner Musk has made no bones about his support for space data centers. Speaking at the U.S.-Saudi Investment Forum held in November, Tesla CEO Elon Musk said:

“The Earth only receives one to two billion of the Sun’s energy. If you want to have something that is 1 million times more energy than Earth could possibly produce, you must go into space. That is where it's handy to have a space company."

The world’s richest man said he sees the cost-effectiveness of AI in space as overwhelmingly better than AI on the ground.

Citing people familiar with the matter, a Wall Street Journal report stated earlier this month that Amazon founder Jeff Bezos’ Blue Origin has had a team working on technology needed for orbital AI data centers for more than a year.

Why Space Data Centers?

Goldman Sachs forecasts that global power demand from data centers will increase by 50% by 2027 relative to 2023 and by as much as 165% by the end of the decade.

| 2025 | 2027 | |

| Power Needs | 55 GW | 84 GW |

| Cloud-Computing Workloads | 54% | 50% |

| Traditional Workloads | 32% | 23% |

| AI workloads | 14% | 27% |

Source: Goldman Sachs<

In an interview with Fox News, Pichais summarized the need for an alternative to data centers. “One of our moonshots is to, how do we one day have data centers in space so that we can better harness the energy from the sun that is 100 trillion times more energy than what we produce on all of Earth today…… But there’s no doubt to me that a decade or so away we’ll be viewing it as a more normal way to build data centers.”

A data center in space is expected to offset many of the negatives of traditional data centers, such as energy consumption, physical space constraints, cooling requirements, and environmental change.

The Challenges

The high cost of deploying data center equipment in space remains a major hurdle, even for deep-pocketed tech giants. Electronic components must be hardened against radiation damage. At the same time, heat management presents another formidable challenge: in space, excess heat can be dissipated only through radiation, not convection, necessitating highly innovative cooling solutions.

In addition, space-based data centers would require a robust satellite network with low-latency inter-satellite links and high-capacity downlinks to Earth, Avalanche Tech executive Danny Sabour said, according to Kratos Space. It also involves satellite networks capable of supporting IP-addressable devices at Layer 2 and Layer 3.The Fringe Beneficiaries

Deutsche Bank said in a report released on Monday that SpaceX, being the industry leader in space research, is well-positioned to capitalize on the opportunity, according to MarketWatch. SpaceX is rumored to have a bloated valuation of $800 billion even before it goes public, and is rumored to go public at a $1.5 trillion valuation in 2026.

The firm also highlighted the following three other smaller names as potential beneficiaries.

-Planet Labs (PL), which has partnered with Alphabet for the latter’s Project Suncatcher

-Rocket Labs (RKLB), which can make satellites at scale and also manufacture components such as solar panels.

-Intuitive Machines (LUNR), through its pending acquisition of Lanteris Space Systems, which has experience making satellites requiring massive amounts of power and heat dissipation

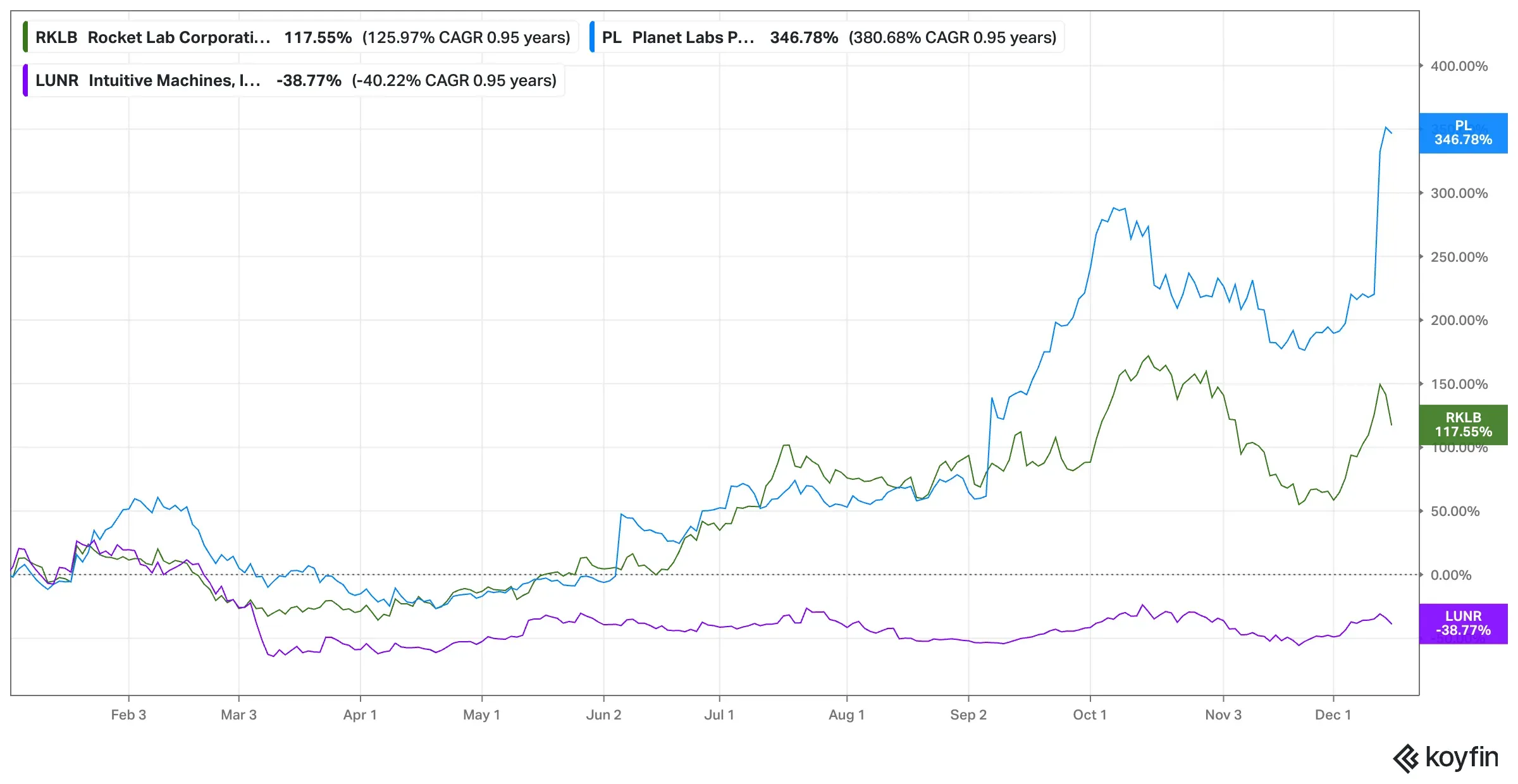

RLKB vs. PL vs. LUNR: YTD Stock Returns

Source: Koyfin<

Retail sentiment toward these smaller space stocks was ‘bullish’ as of early Tuesday, aligning with the buoyant mood seen for much of this year. Year-to-date, RKLB and PL stocks are up about 350% and 120%, respectively, while LUNR stock is down about 40%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<