The company’s strong product performance helped offset pricing pressure and biosimilar competition across parts of its portfolio.

- Amgen beat Q4 estimates and struck an upbeat tone for 2026.

- A broad blockbuster lineup drove 2025 performance, with 14 products generating at least $1B each in annual sales.

- Its pipeline focuses on cardiometabolic, obesity, and oncology, with Repatha backed by Phase 3 data showing a 25% reduction in first major cardiovascular events.

Amgen capped 2025 with a stronger-than-expected fourth quarter (Q4) and said on its earnings call that it expects a “springboard” year ahead.

The stock fell nearly 2% in the regular session on Tuesday but rose nearly 1% in after-hours trading.

AMGN Q4 Results

The company reported adjusted earnings per share of $5.29 for the quarter, beating consensus estimates of $4.76, while revenue rose to $9.9 billion, ahead of expectations of $9.45 billion.

Amgen forecast full-year 2026 revenue of $37 billion to $38.4 billion, compared with consensus estimates of $37.02 billion, and guided for adjusted earnings per share of $21.60 to $23.00, versus expectations of $22.14. The company expects capital expenditures of about $2.6 billion in 2026 and said share repurchases will not exceed $3 billion.

Amgen Blockbuster Products Drove 2025 Performance

Amgen’s financial performance was underpinned by strength in its lineup. The company said 14 products generated at least $1 billion each in annual sales, 13 posted double-digit growth, and 18 delivered record results in 2025. This also helped offset pressure from pricing and biosimilar competition in parts of the portfolio.

Looking ahead, the company highlighted six franchises expected to anchor results in 2026: Repatha, Evenity, Tezspire, rare disease, innovative oncology, and biosimilars. Repatha, Evenity, and Tezspire each grew more than 30% year over year in 2025, supported by expanding patient access and broader prescriber adoption.

Amgen’s Product Pipeline

In cardiometabolic disease, the company pointed to continued momentum for Repatha following results from the Phase 3 Vesalius-CV trial, which showed a 25% relative reduction in first major cardiovascular events among high-risk patients without a prior heart attack or stroke.

Obesity and metabolic disease remain a key focus, with the company advancing MariTide as a late-stage candidate designed for monthly, every-other-month, or quarterly dosing. Six global Phase 3 studies are now underway across chronic weight management, cardiovascular outcomes, heart failure, sleep apnea, and type 2 diabetes.

The company said Olpasiran, its therapy targeting elevated a type of lipoprotein, remains fully enrolled in outcomes testing, though event accrual has been slower than initially expected.

In oncology, the innovative portfolio grew 11% in 2025, led by Imdelltra, which received full FDA approval in extensive-stage small cell lung cancer and has seen rapid adoption in clinical practice.

How Did Stocktwits Users React After AMGN Earnings?

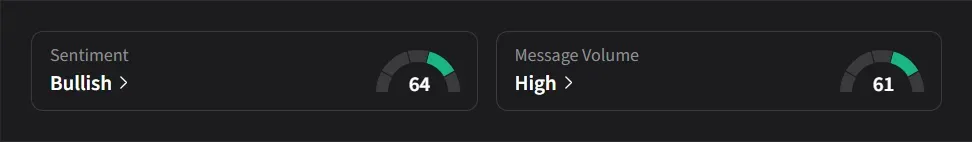

On Stocktwits, retail sentiment for Amgen was ‘bullish’ amid ‘high’ message volume.

One user said Amgen “has been crushing it lately in the big pharma space .”

Another user said that big pharma names such as Amgen and Merck increasingly need ImmunityBio to help improve the performance of their drugs and support their portfolios as patent cliffs approach.

Amgen’s stock has risen 21% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<