synopsis

The March consumer price inflation report and the routinely scheduled weekly jobless claims, both due ahead of the market open, may determine the course of the market on Thursday.

The S&P 500 Index rebounded strongly on Wednesday after shedding more than 12% over three sessions due to uncertainties arising from America's global trade war.

The upside catalyst was a flip-flop by President Donald Trump, who announced a pause in tariffs for most countries, leaving them to pay up only the baseline 10% rate for now.

The S&P 500 dipped as low as 4,984.3, the lowest level since February 2024, before clawing back the losses to end at 5,456.90.

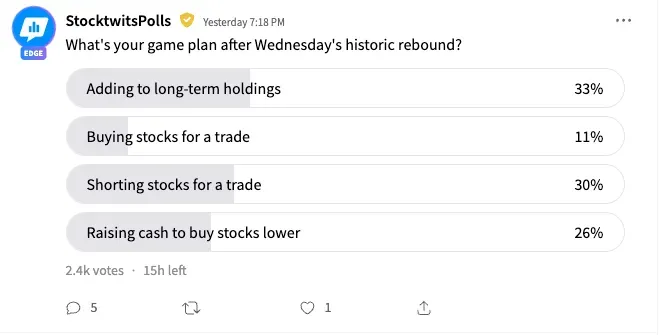

An ongoing Stocktwits poll with over 2,200 responses so far shows mixed sentiment among retail traders following the rebound.

Only 44% expressed confidence — with 33% planning to add to long-term holdings and 11% looking to trade.

Meanwhile, 30% said they would short stocks, while 26% planned to raise cash in anticipation of better buying opportunities.

Those who provided context to their responses were largely pessimistic. One of them said they would wait until things calmed down and lamented that President Trump has "ruined" the U.S. credibility and broken the trust on the world stage.

Another user took potshots at Trump for his unconventional way of announcing the tariff pause, saying Wednesday's recovery was a "fluke."

On Stocktwits, retail sentiment toward the SPDR S&P 500 ETF (SPY) was 'bearish' by late Wednesday, although improving from the 'extremely bearish' mood that prevailed a day ago. The message volume on the SPY stream was 'extremely high.'

The SPY and the Invesco QQQ Trust (QQQ) ETF were the most active tickers on the platform early Thursday.

Market sentiment has aligned with retail's mood, with the major U.S. index futures pointing to a lower open. At the time of writing, Dow futures were down over 1.25%, while the S&P 500 futures were losing more than 1.60%.

The Nasdaq 100 futures Russell 2000 futures the were plunging nearly 2% each.

Bond yields have moderated overnight, with the benchmark 10-year U.S. Treasury yield slipping 10.7 basis points to 4.289%.

The CBOE Volatility Index, a measure of volatility, reversed course and traded abouut 10% higher after plunging hard on Wednesday.

The March consumer price inflation report and the routinely scheduled weekly jobless claims, both due ahead of the market open, may determine the course of the market on Thursday, provided Trump does not trigger volatility with his comments.

In early premarket trading, the SPY stock and the QQQ stock were down over 2.50% each.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

)

subscribe to Asianet News Whatsapp channel by clicking here.

subscribe to Asianet News Whatsapp channel by clicking here.