synopsis

According to an ongoing poll, 43% of the nearly 2,000 respondents believe that growth fears are “overblown.”

Recessionary concerns have dragged crude oil prices to four-year lows as investors fear a slowdown in economic growth exacerbated by the Trump administration’s tariff plans.

At the time of writing, U.S. West Texas Intermediate (WTI) futures were trading at $59.3 a barrel, down nearly 4.9%, after settling at $62.95 on Wednesday – the lowest level since January 2021.

Currently, WTI crude is down more than 16% since Trump’s ‘Liberation Day’ tariffs took effect on April 2.

However, with the administration announcing a temporary pause of 90 days on reciprocal tariffs, WTI crude futures settled 5.7% higher on Wednesday.

According to Goldman Sachs analysts, WTI crude’s current price is slightly higher than the projected $58 barrel price.

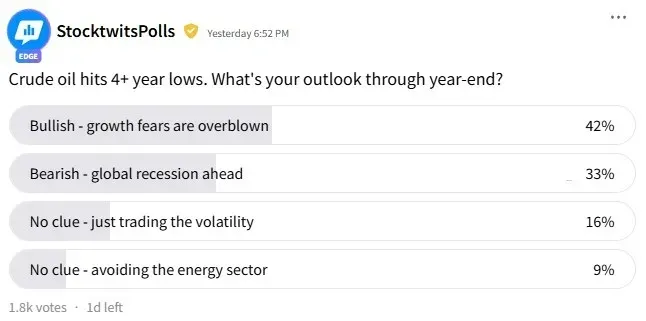

Meanwhile, retail investors on Stocktwits are not as worried about growth prospects. According to an ongoing poll, 43% of the nearly 2,000 respondents believe that growth fears are “overblown.”

A third of the respondents are bearish as they anticipate a global recession ahead.

Sixteen percent of the respondents admitted they have “no clue” and are just trading the volatility, while 8% are avoiding the energy sector altogether.

Amid recession concerns and escalating tariff wars, the SPDR S&P 500 ETF Trust (SPY), which tracks the S&P 500 index, edged lower by over 4% on Thursday.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

)

subscribe to Asianet News Whatsapp channel by clicking here.

subscribe to Asianet News Whatsapp channel by clicking here.