The move brings blockchain-based settlement directly into Visa’s domestic network for the first time.

- Issuer and acquirer partners in the U.S. can now complete settlements using USDC rather than traditional payment methods.

- Initial settlement partners include Cross River Bank and Lead Bank.

- Rising interest in stablecoins from banks and fintech firms has pushed Visa to accelerate its on-chain settlement strategy.

Visa Inc. (V) has taken another step toward modernizing global payments by enabling U.S.-based settlement using USDC, a dollar-backed stablecoin issued by Circle (CRCL).

The move brings blockchain-based settlement directly into Visa’s domestic network for the first time, signaling a shift in how large financial institutions handle money movement.

U.S. Rollout Begins

Issuer and acquirer partners in the U.S. can now complete settlements using USDC rather than traditional payment methods. This capability allows participating banks to move funds continuously throughout the week, including weekends and holidays, without altering the consumer card experience.

Initial settlement partners include Cross River Bank and Lead Bank, which are processing USDC transactions over the Solana blockchain. Visa said it plans to expand access to additional U.S. partners through 2026 as demand grows.

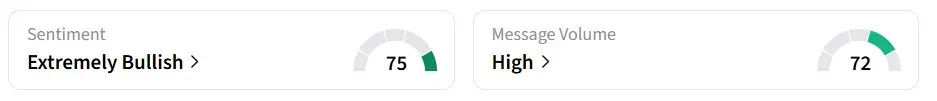

Visa’s stock inched 0.1% higher in Tuesday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘high’ message volume levels.

Why It Matters

Rising interest in stablecoins from banks and fintech firms has pushed Visa to accelerate its on-chain settlement strategy. The company said USDC offers faster settlement speeds and improved liquidity management compared to legacy systems that rely on limited banking hours.

“Financial institutions are looking for faster, programmable settlement options that integrate seamlessly with their existing treasury operations.”

– Rubail Birwadker, Global Head of Growth Products and Strategic Partnerships, Visa

Visa’s move follows years of global experimentation with stablecoin settlement across Latin America, Europe, Asia-Pacific, and other regions. Visa’s U.S. move comes after President Donald Trump’s GENIUS Act, passed in July, provided a formal framework for stablecoin issuers.

With the act in place, dollar-backed digital tokens can move beyond niche crypto systems and become a part of the regular financial infrastructure.

According to a Bloomberg report, Stablecoins are digital currencies created to keep their price steady. Coins like USDC are usually backed by U.S. dollar assets, including Treasury securities.

V stock has gained over 9% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<