Temperatures are projected to remain above normal in the Midwest and Southern U.S. through February 18, according to a Bloomberg report citing the Commodity Weather Group.

- March natural gas futures at Henry Hub were down over 7% to about $3.18 per MMBtu.

- On Friday, U.S. natural gas futures snapped a three-day rally after Baker Hughes reported increased drilling in the Haynesville shale

- ProShares Ultra Bloomberg Natural Gas (BOIL) ETF slid about 14%.

U.S. natural gas fell for a second straight session as forecasts called for warmer weather across much of the country, potentially reducing demand for heating fuel.

With the recent cold wave in the Northeast fading, temperatures are projected to remain above normal in the Midwest and Southern U.S. through February 18, according to a Bloomberg report on Monday, citing the Commodity Weather Group.

Natural Gas Futures Decline

March natural gas futures at Henry Hub were down over 7% to about $3.18 per million British thermal units (MMBtu) at the time of writing, to their lowest levels since January 16. Contracts maturing in April were down 5.6% at $3.08 per MMBtu.

On Friday, U.S. natural gas futures snapped a three-day rally after Baker Hughes reported increased drilling in the Haynesville shale. The rig count rose by seven to 50, lifting the total U.S. gas rig count to 130 from 125. More drilling typically signals higher future supply, which can weigh on prices.

The reversal follows a late-January rally that pushed gas prices to over three-year highs as Winter Storm Fern triggered power outages, production shutdowns, and tighter pipeline flows, especially along the Eastern Seaboard.

ETF Watch

The sharp decline lifted ProShares UltraShort Bloomberg Natural Gas (KOLD), an ETF designed to profit from falling gas prices, by more than 13% on Monday.

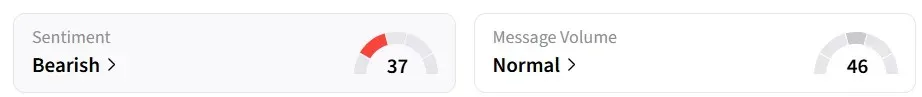

However, retail sentiment on Stocktwits regarding the ETF turned ‘bearish’ from ‘extremely bullish’ the day before.

One user highlighted a resistance at $27. KOLD is currently trading at around $21.

Conversely, ProShares Ultra Bloomberg Natural Gas (BOIL) ETF slid about 14%, with investor sentiment on the platform turning ‘bearish’ from ‘bullish’ a day earlier.

KOLD is down about 43% so far in 2026, while BOIL has shed just over 13%.

Read also: KD Stock Sinks 55% To Over 3-Year Lows – What Triggered This Selloff?

For updates and corrections, email newsroom[at]stocktwits[dot]com.<