He dismissed the view that the recent turn of events has fundamentally altered the foundation of the global financial system as a "pure spin."

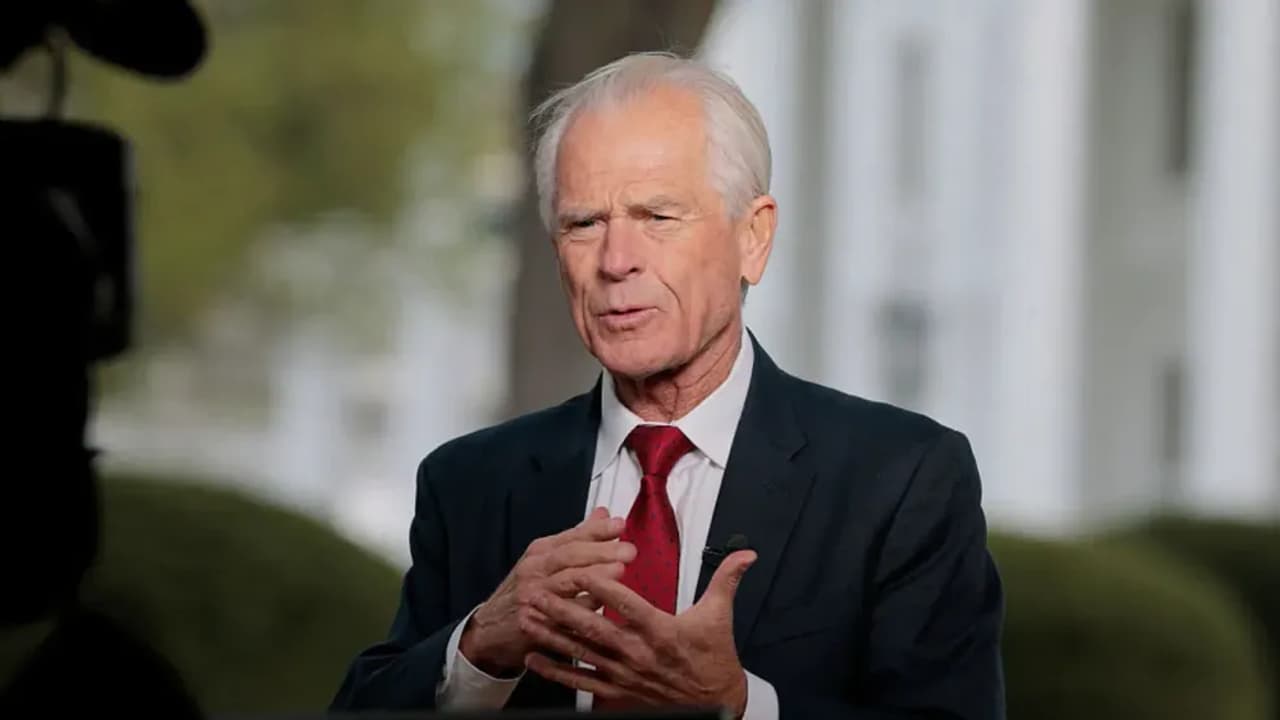

Peter Navarro, an economist and President Donald Trump's senior counselor for trade and manufacturing, downplayed the impact of the president's tariff policy whiplash on the stock market.

After Trump unveiled varied tariff rates for the U.S.'s trading partners on April 2, the financial markets have been in a tailspin, with bond yields shooting through the roof.

Since then, the president has relented and paused the tariff implementation for 90 days for most nations except China.

Navarro aired his views on the tariff fallouts in an interview with CNN late Thursday.

The White House aide dismissed the view that the recent turn of events has fundamentally altered the foundation of the global financial system as a "pure spin."

Pointing to the massive rally on Wednesday, when the S&P 500 jumped by the most since 2008, Navarro said there will be a little pullback. "It's just a normal retracement after a big day. It's no big deal," he added.

Earlier on Thursday, markets moved sharply lower, at one point erasing about half of the previous session's intense surge.

The Trump adviser also pointed to the brighter side of things. Navarro said the good news for Americans is that the 10% base-level tariff rate is still in place, which will help claw back some of the dangerous trade deficit.

He also noted that, with the 90-day pause, at least 90 countries wanted to return to the negotiating table.

Navarro said, "What they're going to do is literally offer us collectively hundreds and hundreds of billions of dollars [of] opportunity to bring manufacturing here, to sell energy there, and do all sorts of things to balance our trade."

While stating that the U.S. is now a beautiful place, the economist blamed the media for stirring people up and causing panic.

Navarro also weighed in on the "queasiness" of the bond market. He said the bond yields were on the way down, benefiting home buyers and people having consumer credit debt.

He also said the Treasury auction on Wednesday went fine, with much participation.

Navarro said the negotiation schedules had been set in motion, with countries such as India, Australia, Great Britain, the European Union, Japan, and South Korea all coming in.

"We're all going to get good deals from them to help the American people," he added.

U.S. stock futures were up slightly early on Friday, offering some respite to investors following multiple days of extreme volatility.

However, investors and analysts are still assessing the threat of a global recession and the overall tariff rate, as the CBOE Volatility Index closed over 21% higher at 40.72 on Thursday.

While crude oil WTI futures were little changed, at just above $60 per barrel, gold futures hit fresh peaks above $3,200 per ounce.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<