synopsis

In the recent week, the U.S. has imposed an additional 145% tariff on Chinese goods; China has slapped an 84% retaliatory tariff on American imports.

Trade tensions between the United States and China could take another severe turn, with America reportedly considering delisting Chinese companies from local bourses.

However, the latest development has not deterred the sentiment for Chinese stocks among Stocktwits users, who say China will soon announce measures to support its businesses.

In an interview with Fox News, U.S. Treasury Secretary Scott Bessent said, "Everything is on the table" in response to a question about potential actions against Chinese companies, including delisting from U.S. exchanges.

His comments followed China's announcement of an 84% tariff rate on American goods in retaliation to new U.S. tariffs, which now stand at 145%.

The escalations have reversed a rally in Chinese stocks, which gained in recent months from enthusiasm over China's progress in artificial intelligence and tech development led by Alibaba Group (BABA), DeepSeek, and Xiaomi.

Torchbearer Alibaba's U.S. shares and the broader KraneShares CSI China Internet ETF (KWEB), which tracks Chinese tech companies, are down about 30% and 23%, respectively, from their peak in mid-March.

In early March, Beijing announced economic stimulus measures, including re-capitalizing local banks and programs to boost household incomes.

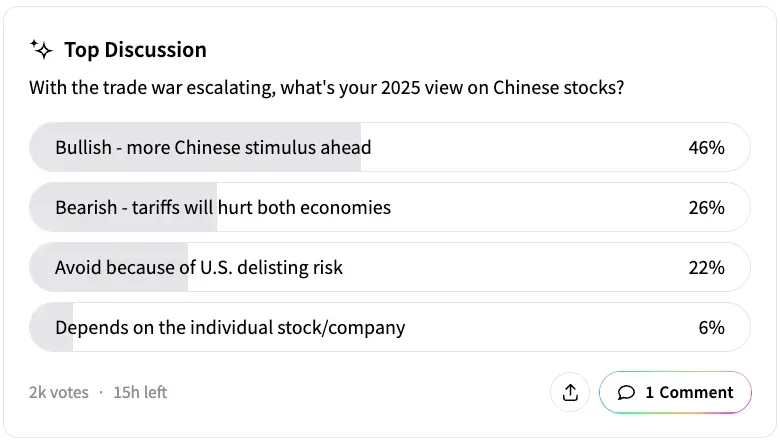

According to an ongoing Stocktwits, 46% of about 2,000 respondents said they were bullish on the prospects of Chinese stocks because Beijing is widely expected to announce new stimulus measures.

Meanwhile, 26% were bearish, given the detrimental effects of current tariffs, and 22% said it was best to avoid Chinese stocks due to the delisting risk.

Major Chinese companies that publicly trade in the U.S. include Alibaba, Yum China (YUMC), NetEase (NTES), PDD (PDD), Nio (NIO), Baidu (BIDU), and JD.com (JD).

As of early Friday, however, retail sentiment on Stocktwits for Alibaba and Chinese tech stocks (KWEB) was 'bearish.' Message volume for both tickers was 'extremely high.'

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

)

subscribe to Asianet News Whatsapp channel by clicking here.

subscribe to Asianet News Whatsapp channel by clicking here.