Analyst warns that the sell-off across crypto markets since early February may signal more than a short-term correction.

- TRON was the only major token to rise, up by 0.06%, while most other large-cap coins stayed in the bearish sentiment.

- In the broader altcoin market, Solana, Ripple, Dogecoin, and Binance Coin were all in the red.

- Analyst Axel Adler Jr. said on-chain data showed the market could be entering a longer bear phase, not just a short dip.

On Tuesday, TRON (TRX) was the only major token trending higher, while the rest of the large-cap tokens traded in line with the market's net bearish sentiment. Bitcoin and Ethereum lead losses, while crypto analysts warned that crypto winter won't end anytime soon.

Over the last 24 hours, TRON's price rose 0.61% to $0.28215. According to Coinglass data, total liquidations for the day were $47,240, with long liquidations of $19,780 and short liquidations of $27,460.

Over the past 24 hours, there were $221.09 million in liquidations, with $145.33 million in long liquidations and $75.76 million in shorts, affecting 84,586 traders. On Stocktwits, the retail sentiment around TRON remained in the ‘bearish’ territory, with chatter increasing from ‘normal’ to ‘high’ levels over the past day.

Bitcoin And Ethereum Still Drive The Liquidation Stack

Bitcoin (BTC) and Ethereum (ETH) traded softer, and the broader top-coins cohort stayed mostly red. BTC remained rangebound near $67,301.58, down 1.5% over the last 24 hours. On Stocktwits, retail sentiment around BTC remained in ‘bearish’ territory, accompanied by ‘low’ chatter levels over the past day. The largest crypto saw a total of $94.03 million in liquidations, with the biggest single liquidation order worth $11.21 million on Hyperliquid (HYPE).

Ethereum’s price was trading at $1,965.43, down 0.81% over the past day, with total liquidations totaling $50.78 million. On Stocktwits, retail sentiment around ETH remained in the ‘bearish’ territory, with chatter around the coin at ‘low’ levels over the past day.

On-Chain Data Suggests Bear Market Not Over Yet

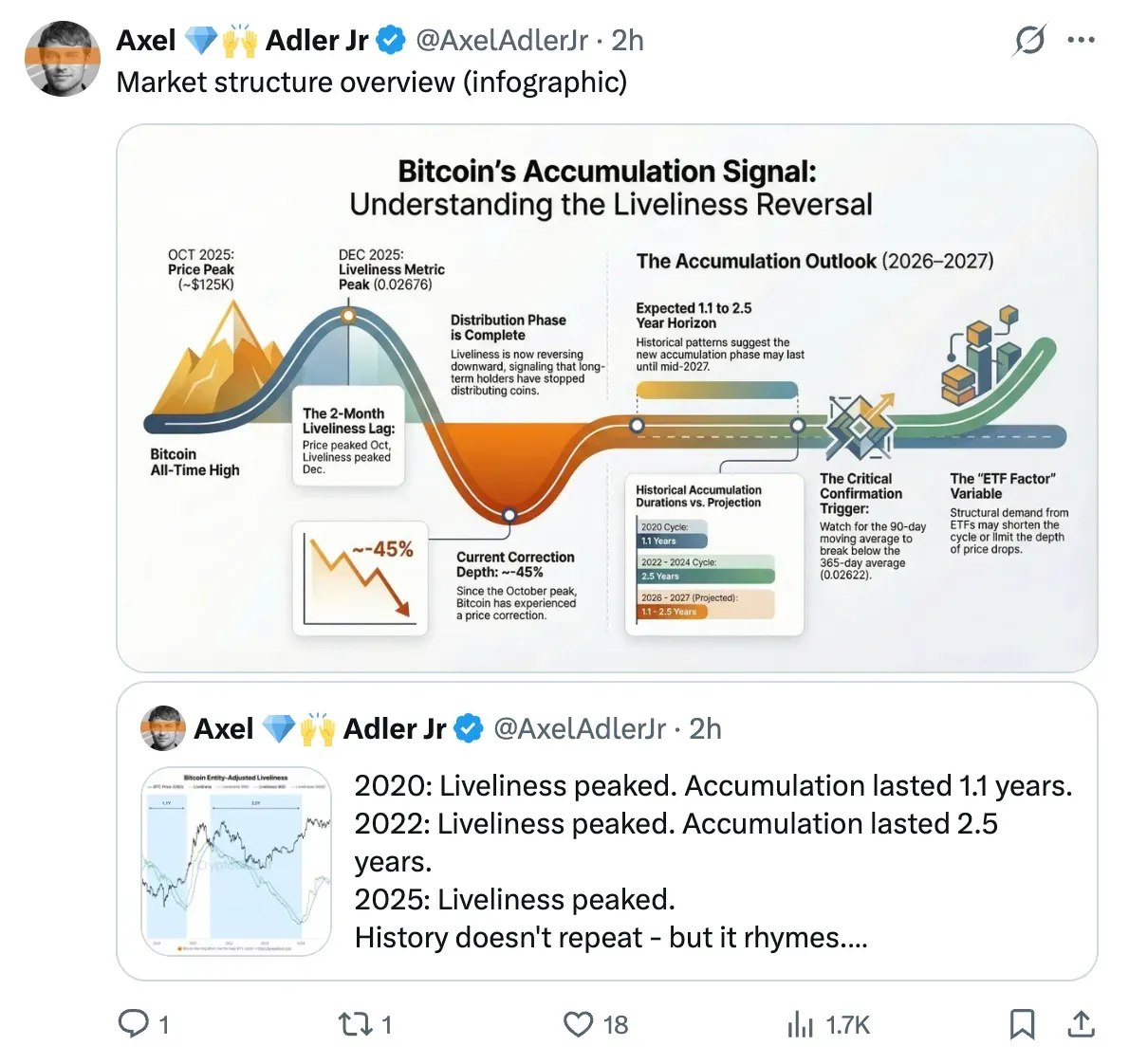

Crypto analyst Axel Adler Jr. said in a blog post that the current Bitcoin downturn is not just a short-term correction. He believes the market is likely in the early stages of a bear cycle and a long accumulation phase, similar to what followed the last bull market, which peaked in 2022 to 2024.

Adler thinks the market is moving from a period when big holders were selling into strength to one in which coins are slowly building up again over many months or even years. He points out on-chain data called Entity-Adjusted Liveliness, which shows whether long-term holders are spending or holding their Bitcoin.

His argument points to the liveliness metric, which peaked after Bitcoin's all-time high in October last year. However, liveliness continued to rise, peaking in December 2025.

Altcoin Market Remains Subdued

Solana (SOL) traded at around $85.31, down by 0.5% in the last 24 hours. On Stocktwits, the retail sentiment around Solana remained in the ‘bearish’ territory, with chatter at ‘normal’ levels over the past day.

Ripple’s XRP (XRP) traded at around $1.45, down by 2.2% in the last 24 hours. On Stocktwits, the retail sentiment around XRP remained in the ‘bearish’ territory, with chatter at ‘low’ levels over the past day.

Dogecoin (DOGE) traded at around $0.09869, down by 3.8% in the last 24 hours. On Stocktwits, the retail sentiment around Dogecoin remained in the ‘bullish’ territory, with chatter at ‘extremely high’ levels over the past day.

Binance Coin (BNB) traded at around $616.75, down by 0.1% in the last 24 hours. On Stocktwits, the retail sentiment around BNB remained in the ‘neutral’ territory, with chatter at ‘normal’ levels over the past day.

Read also: France Emerges As Global Epicenter For Crypto Kidnappings

For updates and corrections, email newsroom[at]stocktwits[dot]com<