synopsis

Shipments in North America fell by a steep 20% owing to lower January production and the initial ramp-up of the updated 2025 model year Ram heavy-duty trucks.

Shares of Stellantis NV (STLA) traded nearly 3% lower in premarket on Friday after the company reported that its consolidated shipments in the first quarter fell by 9% compared to last year.

The company reported consolidated shipments of an estimated 1.2 million units for the quarter, down from 1.3 million in the corresponding quarter of 2024, owing to a drop in shipments in North America and enlarged Europe.

Shipments in North America fell by a steep 20% to 325,000 units. The company attributed the decline to lower January production due to extended holiday downtime and the initial ramp-up of the updated 2025 model year Ram heavy-duty trucks.

Across enlarged Europe, shipments fell by 47,000 units to 568,000 units, representing an 8% decline, owing to a drop in light commercial vehicle volume and primarily due to transition gaps as the company sought to replace vehicles prior-generation products discontinued at the end of the first half of 2024.

Sales in South America, however, jumped by 19% to 211,000 units.

Stellantis launched new and refreshed models in the first quarter, including the Citroën C3 Aircross, Opel Frontera, Fiat Grande Panda, and Ram 2500 and 3500 heavy-duty trucks.

The company said these vehicles helped drive positive momentum in order intake while maintaining normalized dealer inventory.

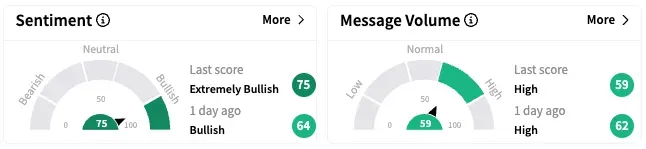

On Stocktwits, retail sentiment around Stellantis rose from ‘bullish’ to ‘extremely bullish’ over the past 24 hours, while message volume remained at ‘high’ levels.

In 2024, Stellantis reported a net profit of €5.5 billion ($6.24 billion), down 70% year-on-year, and recorded a 17% drop in net revenues to €156.9 billion after consolidated shipments fell 12%.

Chairman John Elkann, who is currently leading the company, said that the 2024 results fell short of the company’s potential.

The firm is looking to appoint a new permanent CEO in the first half of 2025 after former CEO Carlos Tavares resigned in December.

STLA stock is down by over 30% year-to-date and over 67% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

(Exchange Rate: 1 EURO= 1.14 USD)<

)

subscribe to Asianet News Whatsapp channel by clicking here.

subscribe to Asianet News Whatsapp channel by clicking here.