The company said that the acquisition adds Faeth’s lead investigational therapy, PIKTOR, to its oncology portfolio.

- The company also secured a private placement financing worth around $200 million.

- Sensei Biotherapeutics plans to use the majority of the proceeds to advance PIKTOR.

- Remaining funds will be used for the development of Sensei’s Phase 1/2 trial candidate, Solnerstotug.

Shares of Sensei Biotherapeutics (SNSE) shot up over 200% on Wednesday after the company strengthened its oncology pipeline by announcing the acquisition of Faeth Therapeutics.

SNSE stock rose to its highest since May 2024 and recorded its biggest-ever intraday gains. Trading in the stock was twice halted after the opening bell, according to Nasdaq data.

The acquisition adds Faeth’s lead investigational therapy, PIKTOR, an all-oral drug combination that targets tumor metabolism and blocks multiple points in the PI3K/AKT/mTOR pathway, a critical cell signaling system that regulates cell survival, growth, and division.

“In the PI3K pathway, the field has repeatedly run into the same constraint. Single-node inhibitors force a tradeoff between efficacy and tolerability. PIKTOR is designed to change that tradeoff by inhibiting PI3K-alpha and mTORC1/2 simultaneously, and we believe we can achieve more complete pathway suppression with improved tolerability,” said Anand Parikh, Co-founder of Faeth Therapeutics and the new COO and director of Sensei.

$200 Million Private Placement

Sensei Biotherapeutics also secured private placement financing, worth about $200 million. The company plans to use most of the capital to advance PIKTOR, including topline results from an ongoing Phase 2 trial in second-line advanced endometrial cancer and the launch of a Phase 1b study in HR+/HER2- advanced breast cancer, both anticipated by the end of 2026.

Remaining funds will support general corporate initiatives and the continued development of Sensei’s Phase 1/2 trial candidate, Solnerstotug.

The private placement attracted participation from B Group Capital, Balyasny Asset Management, Columbia Threadneedle Investments, and Vivo Capital, among other life sciences funds and institutional investors.

How Did Stocktwits Users React?

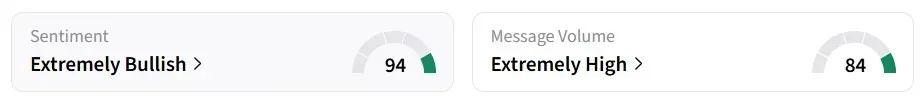

Retail sentiment on Stocktwits flipped to ‘extremely bullish’ from ‘bearish,’ amid ‘extremely high’ message volumes.

One user expects the stock to “go up big” if it holds above the $25.4 to $25.5 support. It is currently trading at around $28.

Another user expects the stock to climb to $44 by the end of the session.

The stock has gained around 160% so far in 2026.

Read also: RXT Stock Soared 275% Today – What’s The Connection With Palantir?

For updates and corrections, email newsroom[at]stocktwits[dot]com.<