Rivian said the "complexity" of rolling out the lower-priced SUV will hurt gross profit in early 2026 before becoming a tailwind later in the year.

- Investors locked in profits and reassessed concerns around 2026 guidance and delayed international plans for the R2 SUV.

- Several Wall Street firms maintained cautious ratings and flagged downside risks.

- Near-term margin pressure from the R2 launch also weighed on sentiment.

Rivian’s (RIVN) stock is giving back some gains overnight on Monday, just one session after posting its biggest gain ever, as investors locked in profits and weighed concerns over 2026 guidance and delayed international plans for the R2 SUV.

RIVN stock slipped more than 1% in overnight trading on Monday after jumping nearly 30% to $17.73 on Friday, its highest level in about a month.

Wall Street View On RIVN

Several analysts raised price targets after Rivian’s fourth-quarter (Q4) report, but many maintained cautious ratings and highlighted risks that weighed on the stock following its sharp rally.

At Mizuho, the firm raised its price target to $11 from $10, implying a 38% downside from the stock’s last close, and maintained an ‘Underperform’ rating. Mizuho said Rivian issued a “good outlook” following the quarter, while adding that the broader EV market remains challenged.

Wells Fargo lifted its price target to $15 from $12, representing a 15% downdside from current levels, and kept an ‘Equal Weight’ rating. The brokerage noted that Rivian’s adjusted EBITDA beat consensus in Q4, but said the company’s 2026 guidance fell short of expectations and flagged risk to the 2026 adjusted EBITDA outlook.

Piper Sandler lowered its price target to $18 from $20, implying a 2% upside from the stock’s last close, while maintaining a ‘Neutral’ rating. It said Rivian delivered “respectable” Q4 results that topped expectations, but pointed to 2026 EBITDA loss guidance of $1.8 billion to $2.1 billion, which it said implies “slight” downside versus consensus estimates of about $1.8 billion.

Meanwhile, Cantor Fitzgerald raised its price target to $18 from $15, also implying a 2% upside from current levels and reiterated a ‘Neutral’ rating. The firm cited the upcoming R2 launch, AI-driven customer focus, and partnerships with Amazon and Volkswagen as potential demand drivers, while stressing that its near-term stance remains neutral pending clearer visibility on customer uptake and autonomy timelines.

More bullishly, Benchmark raised its price target to $25 from $18, implying a 41% upside from the stock’s last close, and kept a ‘Buy’ rating. The brokerage said Rivian is “increasingly well positioned” to scale toward long-term profitability following the quarter.

R2 Rollout Outside US Adds To Caution

Sentiment was also weighed down by signs that Rivian has adjusted the international timeline for its lower-priced R2 SUV. The company removed a previously stated 2027 target for Europe from its website, replacing it with a message that says “Rivian is coming to Europe — be one of the first to get the latest news and updates” without specifying a launch year.

For Canada, Rivian now lists the R2 as “coming 2027,” later than the earlier 2026 timeline, and has removed previously displayed Canadian pricing. Rivian’s U.S. launch plans remain unchanged, with full pricing and specifications due on March 12.

R2 Launch To Pressure Margins In Early 2026

The overnight pullback also reflects profit-taking after Rivian’s sharp rally, as investors digested management’s comments that the R2 launch will pressure margins in early 2026. On the company’s Q4 earnings call last week, the company said the “complexity” of launching R2 is expected to weigh on automotive gross profit in the first half of the year before turning into a tailwind later in 2026 as production and deliveries scale.

Rivian expects to deliver between 62,000 and 67,000 vehicles in 2026, up from 42,247 in 2025, with R2 accounting for most of the growth. Deliveries are expected to remain modest early in the year, then accelerate in the second half as production ramps from a single shift to additional shifts, depending on supplier readiness.

How Did Stocktwits Users React?

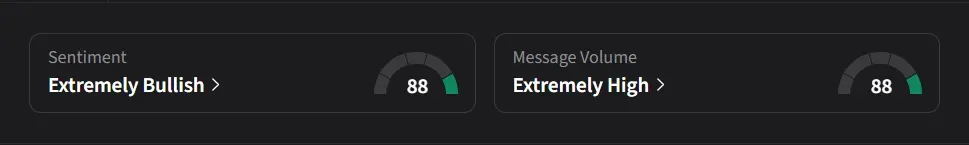

On Stocktwits, retail sentiment for Rivian was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said, “Even as an Asian investor, I am rooting for the US and betting big on American potential. I have absolutely zero doubt that Rivian, a 100% American company, will succeed.”

Another user said, “Smart money is buying. R2 is imminent. Rivian is the only true successor to Tesla. Unlike NIO, Rivian is 100% American—US jobs, US manufacturing. Support American innovation or go bet on China.”

RIVN stock has risen 33% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<