The company now expects annual recurring revenue to exceed $200 million at the end of 2025, double its initial projection of $100 million.

- The announcement comes after factoring in contracted customer agreements and the company's year-end billings, buoyed by Rezolve’s partnerships with Microsoft and Google for its agentic platform.

- The company also expected December revenues to exceed $17 million, making it the strongest month in its history.

- Rezolve said it anticipated a GAAP net loss due to non-cash items and one-time costs, with positive adjusted EBITDA.

Rezolve AI (RZLV) shares rallied nearly 27% on Tuesday morning after the company announced that its preliminary, unaudited year-end results show annual recurring revenue (ARR) for 2025 is expected to be double its original estimation.

Rezolve now expects its ARR to exceed $200 million at the end of the year, which is double the company’s original objective of $100 million. This comes after factoring in the company's contracted customer agreements and year-end billings.

The company also predicted that December would be its strongest month in history, with revenue expected to exceed $17 million. Although it anticipates a GAAP net loss due to non-cash items and one-time costs, it sees a positive adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA).

Partnerships And Blue-Chip Adoption

Rezolve’s performance comes amid the rapid growth of its agentic commerce platform, which is used by over 650 enterprises globally across retail, hospitality, financial services, and other sectors.

The company’s Rezolve Brain Suite, the enterprise AI platform powered by its proprietary LLM, brainpowa, has seen rapid uptake following its integrations with Microsoft and Google. In 2024, Rezolve entered into partnerships with both companies to bring Brain Suite to Microsoft’s Azure Marketplace and Google Cloud.

Rezolve has also built a client roster that includes major global retailers such as Adidas, Burberry, Gucci, Tommy Hilfiger, PUMA, Target, Standard Chartered, and Commerzbank, among others.

The company noted that it has processed over 51 billion API calls across Brain Commerce, hosted over 340 million unique mobile user sessions, and reached 57.7 million consumer devices through its SDK.

2026 Guidance

Rezolve AI reaffirmed its expectation of $500 million or more in ARR at the end of 2026, in line with previously issued guidance. This would amount to an implied monthly recurring revenue of over $40 million by December 2026.

“2025 has been a breakthrough year for Rezolve AI,” said Daniel M. Wagner, Chairman and CEO at Rezolve AI. “We now have extraordinary momentum heading into 2026 with strong revenue visibility, a growing base of contracted recurring revenue, and increasing confidence in our path forward.”

How Did Stocktwits Users React?

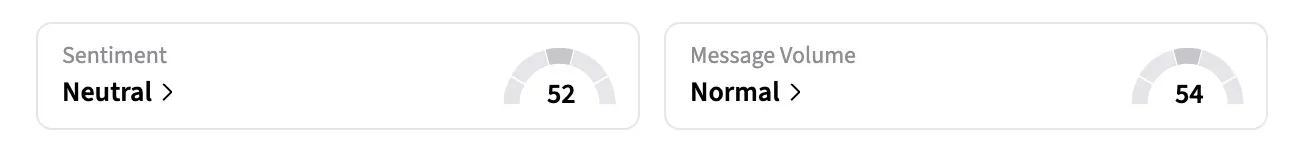

On Stocktwits, the retail sentiment around RZLV jumped to ‘neutral’ from ‘bearish’ levels over a week ago, and message volume climbed to ‘normal’ from ‘low’ levels at the time of writing. RZLV was also among the top trending stocks on the platform.

One user believes RZLV is one of the best up-and-coming stocks.

Shares of RZLV climbed more than 33% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<