synopsis

Citi said Nvidia can partially pass down the increased GPU cost that may emanate from the trade war, given its technology leadership and AI GPU price in-elasticity.

Nvidia Corp. (NVDA) shares have been highly volatile this year as they gyrated between reports of a slowdown in artificial intelligence (AI) spending and the geopolitical news surrounding tariffs.

The stock trades down nearly 28% from its all-time high of $153.13, hit on Jan. 7, although it ended Friday’s session up 3.12% at $110.93.

Nvidia was among the top five trending stocks on Stocktwits early Monday and it was also among the top 15 most-trending tickers.

Retail investors are hopeful that the worst may be behind them.

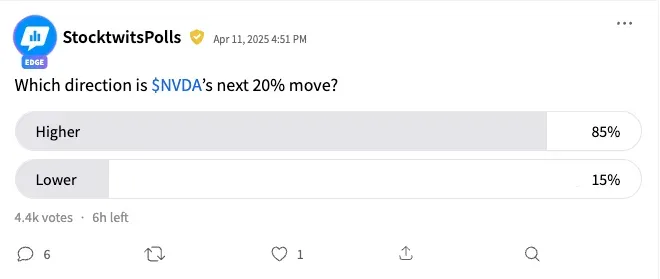

An ongoing Stocktwits poll that has collected responses from 4,400 users so far found that an overwhelming majority (85%) said the next 20% move in Nvidia stock is to the upside.

The remaining 15% opined that the next 20% move will be lower.

The rise in the major U.S. index futures suggests that the broader market is headed for a positive open.

Nvidia stock, however, could see some volatility. Commerce Secretary Howard Lutnick and President Donald Trump said separate tariffs would be worked out for semiconductor imports after the customs department announced an exemption for tech products late Friday.

The sentiment meter on Stocktwits confirmed the positive outlook. Retail sentiment toward the Nvidia stock stayed ‘bullish’ (55/100), and the message volume stayed ‘high.’

A bullish watcher expected an 8%-12% rise in Nvidia stock on the tariff exemption for tech products.

Another user based his bullish view on the potential for artificial intelligence (AI).

Although analysts trimmed their price targets for Nvidia stock following the recent stock sell-off, they remained optimistic regarding the fundamentals.

The Fly reported Friday that Citi reduced the price target for Nvidia’s stock to $150 from $163 but maintained a ‘Buy’ rating.

Given its technology leadership and AI GPU price inelasticity, the firm thinks Nvidia can partially pass down the increased GPU cost that may emanate from the trade war.

The Koyfin-compiled average analysts’ price target for Nvidia stock is $167.78, implying a potential upside of over 51% from current levels.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

)

subscribe to Asianet News Whatsapp channel by clicking here.

subscribe to Asianet News Whatsapp channel by clicking here.