The Canadian hedge fund manager, known for his early bet on Carvana, has emerged as a key stock picker.

- Hedge fund manager Eric Jackson, known for his Opendoor bet, announced on Tuesday his new venture: a digital-asset treasury (DAT) company that will acquire cryptocurrencies.

- Jackson’s EMJ Crypto Technologies is merging with publicly-listed healthcare firm SRx Health Solutions.

- The move comes at a time when DAT firms have lost favour with investors amid Bitcoin’s underperformance.

Stocktwits has been closely tracking Canadian hedge fund manager Eric Jackson and his marquee bet, Opendoor Technologies – the year’s runaway meme stock. So when the EMJ Capital founder unveiled his new flagship venture, a crypto-treasury company, it’s worth digging deeper and examining how his past calls, bullish and bearish, have played out.

‘EMJX’

Jackson, known for his early bet in Carvana, another stock that has been flying high, on Tuesday announced EMJ Crypto Technologies, or EMJX, calling it “Gen2 treasury operating system.” EMJ Crypto is a digital-asset treasury company, or DAT, that will invest in Bitcoin and Ether, among other tokens.

EMJ Crypto will be combining with SRx Health Solutions Inc., a little-known firm that operates in the specialty healthcare space, the latter announced on Tuesday, prompting a 23% surge in its stock. The deal is expected to close in early next year, following which Jackson would become the CEO of the combined firm.

Downturn For Crypto-Treasury Companies

The timing is probably not the best. Strategy, formerly known as MicroStrategy, popularized the DAT strategy in 2020 when it began loading up on Bitcoin as an alternative treasury asset. This year, under a crypto-friendly Donald Trump administration, more companies – most notably GameStop – have jumped on the bandwagon amid a broader hype cycle around cryptocurrencies, including stablecoins and other digital tokens.

However, the hype has failed to materialize in returns. The market capitalization of Statregy has fallen below the value of its Bitcoin holdings. In contrast, GameStop – once the most-watched meme stock in the market – has left investors frustrated, with no hint of an upsurge. Bitcoin has slid sharply since October and is now down 2.6% since the start of the year.

Will EMJX Succeed?

Jackson thinks he can outdo the so-called DAT companies. “I thought what the world needs is a Gen-2 treasury company with multiple assets: build a risk system around that treasury; treat the volatility as an input so it doesn’t suffer enormous drawdowns,” he told Bloomberg News in an interview. He plans to hedge the firm’s bets with puts and calls, he added.

As part of the deal, SRx shareholder Keystone Capital Partners has pledged up to $1 billion to purchase an additional 2.5 billion shares if the company chooses to sell.

Jackson’s Report Card

Jackson currently runs his $10 million hedge fund, EMJ Capital Ltd. The investor, who had an activist position in Yahoo a decade ago and started a long position in Carvana in 2023 (one of his most successful bets to date), has recently expanded his purview.

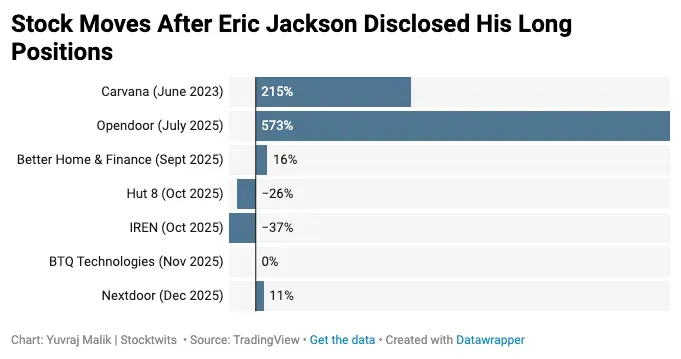

Besides his famous bet on Opendoor in July, which sparked a multi-fold rally in the stock, Jackson has, in recent months, disclosed long positions in Better Home & Finance, BTQ Technologies, Hut 8 Corp, IREN Ltd, and, most recently, Nextdoor. He also put out a slightly negative X thread on Shopify. Here’s a look at how these companies have done since Jackson’s positions.

Nearly all of the above-mentioned stocks spiked after Jackson disclosed his position, with Nextdoor losing the momentum right after the rally. Carvana has risen sharply this month after posting strong results and ahead of its inclusion in the S&P 500 index next week.

With 124% gains year-to-date, Carvana has been one of the top stocks for the year. However, the Stocktwits sentiment for CVNA entered the ‘extremely bullish’ zone fewer times in the second half of the year than in the first half, with the latest reading showing ‘bearish.’ That said, the stock saw a 250% year-over-year increase in chatter and an over 18% increase in watcher count in 2025.

For retail traders, Opendoor, IREN, and BTQ were the top stocks of interest, according to Stocktwits data. Watcher count for BTQ and IREN rocketed by 700% and 277%, respectively, over the past year, while Opendoor saw a whopping 1,122% jump in message volume. Opendoor has largely traded within a range since mid-September, with even a warrant issue failing to lift the stock, and sentiment has been mainly in the ‘bearish’ zone during this period.

As of the latest reading, the Stocktwits sentiment was ‘bearish’ for HUT, BTQ, OPEN and CVNA, ‘bullish’ for IREN, ‘neutral’ for BETR, and ‘extremely bullish’ for NXDR.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<