synopsis

Fitch Ratings said in a note that the tariffs are raising the dangers of an economic recession in much of the world.

Oil stocks fell in extended trading on Wednesday following a decline in oil prices after U.S. President Donald Trump unveiled a fresh set of tariffs that raised concerns over fuel demand.

Trump slapped a minimum 10% tariff on most goods imported into the U.S. from the White House on Wednesday, raising concerns over a global trade war that could hinder oil demand.

"We know it will be negative for trade, economic growth and thus oil demand growth. But we don't know how bad it will be as the effects come a little bit down the road," Bjarne Schieldrop, chief commodities analyst at SEB, told Reuters.

Fitch Ratings said in a note that the tariffs are raising the dangers of an economic recession in much of the world.

"The U.S. tariff rate on all imports is now around 22% from 2.5% in 2024. That rate was last seen around 1910," Olu Sonola, head of U.S. economic research at Fitch, said.

However, the White House said most energy products, including crude oil, are exempted from the tariffs announced on Wednesday.

The Energy Select Sector SPDR Fund (XLE) and Vanguard Energy ETF (VDE) fell 2.3% and 2.6%, respectively.

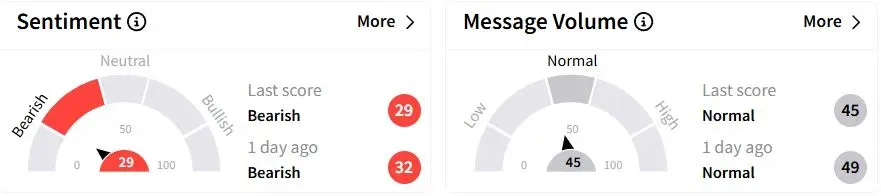

Retail sentiment on Stocktwits moved lower into the ‘bearish’ (29/100) territory than a day ago, while retail chatter was ‘normal.’

Despite the bearish sentiment, one retail trader said that “rotation to energy could be in play” as it was largely spared from the tariffs.

Chevron (CVX), Exxon Mobil (XOM), ConocoPhillips (COP), and Occidental Petroleum (OXY) fell between 1.8% and 2.7%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

)

subscribe to Asianet News Whatsapp channel by clicking here.

subscribe to Asianet News Whatsapp channel by clicking here.