synopsis

nCino’s “Remaining Performance Obligations” rose 19% YoY to $1.095 billion as of Oct. 31, 2024.

nCino, Inc. ($NCNO), a platform provider for the banking industry, announced fiscal year 2025 third-quarter results that exceeded expectations but its outlook was subpar, sending its stock sharply lower in premarket trading on Thursday.

Wilmington, North Carolina-based nCino reported third-quarter earnings per share (EPS) of $0.21, exceeding the year ago’s $0.14 and the consensus of $0.16.

Revenue climbed 14% year-over-year (YoY) to $138.8 million versus Wall Street’s estimate of $137.35 million.

Remaining performance obligations (RPO) rose 19% YoY to $1.095 billion as of Oct. 31, 2024. RPO expected to be recognized in the next 12 months is $730 million, up 16%.

Pierre Naudé, Chairman and CEO at nCino, said, “The team delivered solid execution globally, with over 30 multi-solution deals and more gross bookings from net new customers than the previous two quarters combined.”

Cash position at the end of the quarter was $258.3 million.

Looking ahead, nCino guided fourth-quarter non-GAAP EPS to $0.18-$0.19 and revenue to $139.5 million—$141.5 million.

This compares to the consensus estimates of $0.19 and $143.59 million, respectively.

The company raised its fiscal year 2025 non-GAAP EPS guidance from $0.66-$0.69 to $0.75-$0.76 and narrowed its revenue guidance from $538.5 million—$544.5 million to $539 million—$541 million.

Analysts, on average, expect non-GAAP EPS of $0.69 and revenue of $541.02 million.

Following the results, Piper Sandler downgraded the stock from “Overweight” to “Neutral,” and maintained the price target at $38, Fly reported. The firm said elevated churn within the mortgage presents a $10 million revenue headwind for the full year and pressured fourth-quarter organic growth outlook.

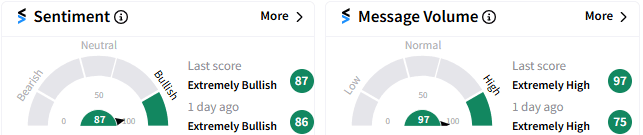

Retail sentiment toward nCino remained ‘extremely bullish’ (87/100) on the Stockwits platform, with message volume remaining ‘extremely high.’

In premarket trading, as of 7:52 a.m. ET, nCino shares fell 20% to $34, marking their lowest level since Oct. 11. The stock has gained over 26% for the year.

For updates and corrections email newsroom[at]stocktwits[dot]com.<

)

subscribe to Asianet News Whatsapp channel by clicking here.

subscribe to Asianet News Whatsapp channel by clicking here.