The company reported a 547% year-on-year increase in Q4 revenue to $227.7 million, which was below the analysts’ consensus estimate of $242.79 million, according to Fiacla AI data.

- The company achieved positive group adjusted earnings before interest, taxes, depreciation, and amortization of $15 million in Q4.

- Cost of revenue rose to $68.5 million in Q4 from $21.1 million a year ago, reflecting the expansion in data centers and related leasing agreements.

- CEO Arkady Volozh said the company looks to end 2026 with annual recurring revenue between $7 billion and $9 billion.

Nebius Group N.V. (NBIS) drew significant interest from retail traders on Wednesday after the company reported its fourth-quarter (Q4) earnings.

The company reported a 547% year-on-year increase in Q4 revenue to $227.7 million, which was below the analysts’ consensus estimate of $242.79 million, according to Fiacla AI data.

How Did Stocktwits Users React?

Following the announcement, Nebius’ stock traded over 5% lower on Thursday morning.

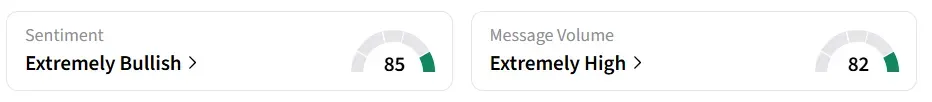

However, on Stocktwits, retail sentiment around the stock improved to ‘extremely bullish’ to ‘bullish’ territory the previous day. Message volume shifted to ‘extremely high’ from ‘high’ levels in 24 hours.

The stock saw an 80% surge in retail messages over the past 24 hours as of Thursday morning.

A Stocktwits user lauded the earnings and said the company is ‘going in [the] right direction’.

Another user emphasized that Nebius is playing the long game and long-term investors will be happy.

Cost And Operational Efficiency

The firm’s cost of revenue rose to $68.5 million in Q4 from $21.1 million a year ago, reflecting the expansion in data centers and related leasing agreements. Despite the increase, costs as a percentage of revenue fell to 30%, down from 60% last year, signaling improved operating leverage.

“We are on track to end the year with ARR of $7 billion to $9 billion.”

-Arkady Volozh, Founder and CEO, Nebius

The company achieved positive group adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $15 million in Q4, a turnaround from a $63.9 million loss a year earlier. The core AI cloud segment generated $51.8 million in adjusted EBITDA, with a 24% margin, offsetting losses from other business units such as Avride and TripleTen.

NBIS stock has gained over 121% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<