The IPO features an expanded share count, with proceeds directed toward debt reduction and corporate needs.

- Share count increased from the preliminary filing, with underwriters also granted an option for additional shares.

- Proceeds are earmarked largely for debt repayment and balance sheet strengthening.

- The company enters public markets backed by steady revenue growth and long-term customer contracts.

Medline Inc. (MDLN) said it has priced its upsized initial public offering at $29 a share after increasing the share count from its earlier filing, clearing the way for the medical-supplies giant to debut on the Nasdaq Global Select Market on Wednesday.

The company will offer about 216 million Class A shares, up from the 179 million shares outlined in its preliminary filing last week, and has granted underwriters a 30-day option to purchase up to an additional 32.4 million shares. The IPO is expected to close on Thursday.

Use Of Proceeds

Medline said most of the proceeds from the IPO will go toward strengthening its balance sheet. The company plans to use the net proceeds from 179 million newly issued shares to repay outstanding debt under its senior secured term loan facilities, with the rest earmarked for general corporate purposes and offering-related expenses.

Proceeds from another 37 million shares, along with any shares sold if underwriters exercise their option, will be used to buy out an equivalent number of equity interests from certain pre-IPO owners.

Medical Supply Giant At Scale

Medline describes itself as the largest provider of medical-surgical products and supply chain services by net sales. Its product catalog spans about 335,000 items used across hospitals, surgery centers, doctors’ offices and post-acute care facilities.

About one-third of Medline’s branded products are made in-house at 33 manufacturing facilities. The rest are sourced from more than 500 suppliers across roughly 40 countries. Through its Supply Chain Solutions segment, Medline also distributes about 145,000 third-party products and offers inventory and logistics support to customers.

Prime Vendor Relationships Underpin Sales

Medline generated $20.6 billion in net sales and $1 billion in profit over the first nine months of 2025, along with $2.7 billion in core profit. In 2024, the company brought in $25.5 billion in revenue and $1.2 billion in net income. Medline said its sales have grown every year since the company was founded, supported by a large base of recurring revenue.

Prime Vendor agreements, which are long-term contracts under which Medline serves as a primary supplier of medical products, accounted for $16 billion in net sales in 2024. Medline said its Prime Vendor retention rate has averaged more than 98% over the past five years.

How Did Stocktwits Users React?

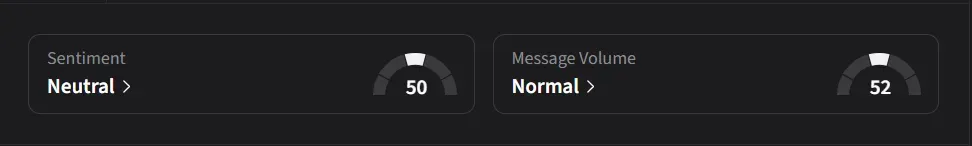

On Stocktwits, retail sentiment for Medline was ‘neutral’ amid ‘normal’ message volume.

One user said they likely wouldn’t get their pre-IPO order filled at $30, calling the price too high.

For updates and corrections, email newsroom[at]stocktwits[dot]com.