B. Riley raised its price target on Lam Research to $195 from $180.

- B. Riley has maintained a “Buy” rating on the stock.

- The firm told investors in a research note that Lam Research's "superior" memory exposure and Etch leadership offer outsized leverage to accelerating memory wafer fab equipment spend.

- Mizuho has also raised its price target on the stock to $200 from $170.

Shares of semiconductor equipment maker Lam Research (LRCX) rose more than 9% on Thursday after analysts at B.Riley raised their price target on the stock to $195 from $180 and kept a “Buy” rating.

According to TheFly, B. Riley told investors in a research note that Lam Research's "superior" memory exposure and Etch leadership offer outsized leverage to accelerating memory wafer fab equipment (WFE) spend.

Shares of Lam Research have more than doubled so far in 2025, driven by rising chip demand and the global adoption of AI.

Demand for equipment used to make computer chips is expected to rise in the coming years as chipmakers continue to expand capacity to meet increasing demand driven by the adoption of artificial intelligence. It is set to benefit companies like Lam Research, which have been spending heavily to expand the supply of its wafer fab equipment.

Industry group SEMI said in a report that growth in global sales of semiconductor manufacturing equipment by OEMs is projected to reach a record high of $133 billion in 2025, with projections of $145 billion in 2026 and $156 billion in 2027.

Mizuho Take

Mizuho analyst Vijay Rakesh, who has also raised the price target on the stock to $200 from $170, said that the firm sees upside to the 2026 wafer fab equipment estimate, and the improving WFE outlook is positive for Lam Research.

Lam Research has forecasted its second-quarter revenue above estimates, according to the data from Fiscal.ai. It expects second-quarter (Q2) revenue of $5.20 billion, plus or minus $300 million, with the higher end above analyst estimates of $5.23 billion.

How Did Stocktwits Users React?

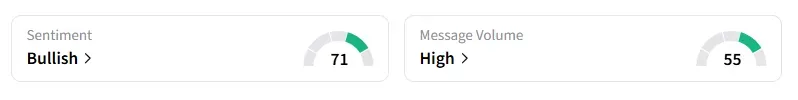

On Stocktwits, the retail sentiment around LRCX remained ‘bullish’, and message volume remained ‘high’.

LRCX stock has gained over 125% this year.