Luxury vacation company Exclusive Investments will take over Inspirato in a deal valued at $59 million.

- The take-private deal comes at a 50% premium to ISPO’s closing price as of Dec. 16, 2025.

- Exclusive Investments will pay $4.27 per share in an all-cash transaction expected to close in early 2026.

- Current Chairman and CEO, Payam Zamani, will step down after the deal.

Inspirato Incorporated (ISPO) shares soared over 46% on Wednesday after the company announced a take-private deal just about four years after its public listing.

The luxury vacation company will be acquired by Exclusive Investments LLC for $59 million, indicating approximately a 50% premium to ISPO’s closing price on Dec. 16, 2025. The deal is expected to close in early 2026.

The deal comes amid significant financial and operational challenges for Inspirato. Chairman and CEO of the company, Payam Zamani, indicated that the deal would be a positive step for stakeholders after a year’s effort to stabilize and strengthen the business.

Deal Contours

Exclusive Investments, a noted luxury travel and real estate company, will pay $4.27 per share in an all-cash transaction approved by the Board. Notably, Inspirato’s largest shareholder is Zamani, currently controlling about 36% of the company’s common stock. Zamani has approved the deal and agreed to vote his shares in favor of the transaction.

After going private, Zamani is expected to step down from his role as Chairman and Chief Executive Officer. James Henderson, CEO of The Exclusive Collective and Exclusive Resorts, will take over as the interim CEO of the company.

“Following a year dedicated to stabilizing and strengthening the business, this agreement represents another positive step forward for Inspirato’s customers, employees, partners, and shareholders,” Zamani said.

Financial Challenges

Inspirato has indicated several financial challenges in the recent past. In its latest quarterly results, the company reported a nearly 20% decline in revenues from the same period last year and about 15% drop for the nine months in 2025. Occupancy rates for the quarter also declined to 56% from 73%.

In June this year, Inspirato announced a deal to combine with Buyerlink, a marketing technology platform, through a reverse merger. The deal aimed to transform Inspirato from a standalone luxury travel club into a technology-driven marketplace business spanning luxury travel, automotive, and home services. However, the deal was terminated in September.

Inspirato went public in Feb. 2022 through a merger with Thayer Ventures.

How Did Stocktwits Users React?

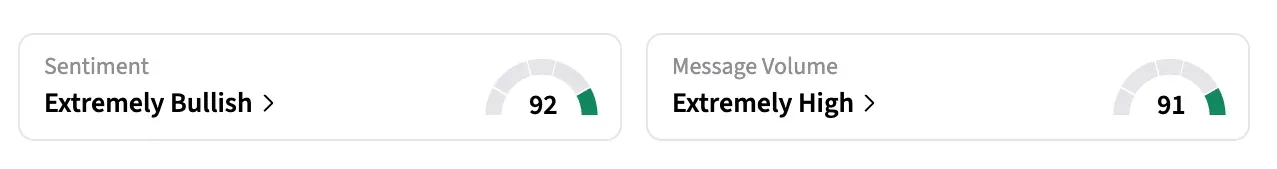

On Stocktwits, the retail sentiment around ISPO jumped to ‘extremely bullish’ from ‘neutral’ levels a day ago, and message volume jumped to ‘extremely high’ from ‘low’ levels.

Shares of ISPO are up over 27% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<