Black added that while the Tesla stock has the potential to go higher, his caution is driven by weak fourth-quarter volumes for the EV maker.

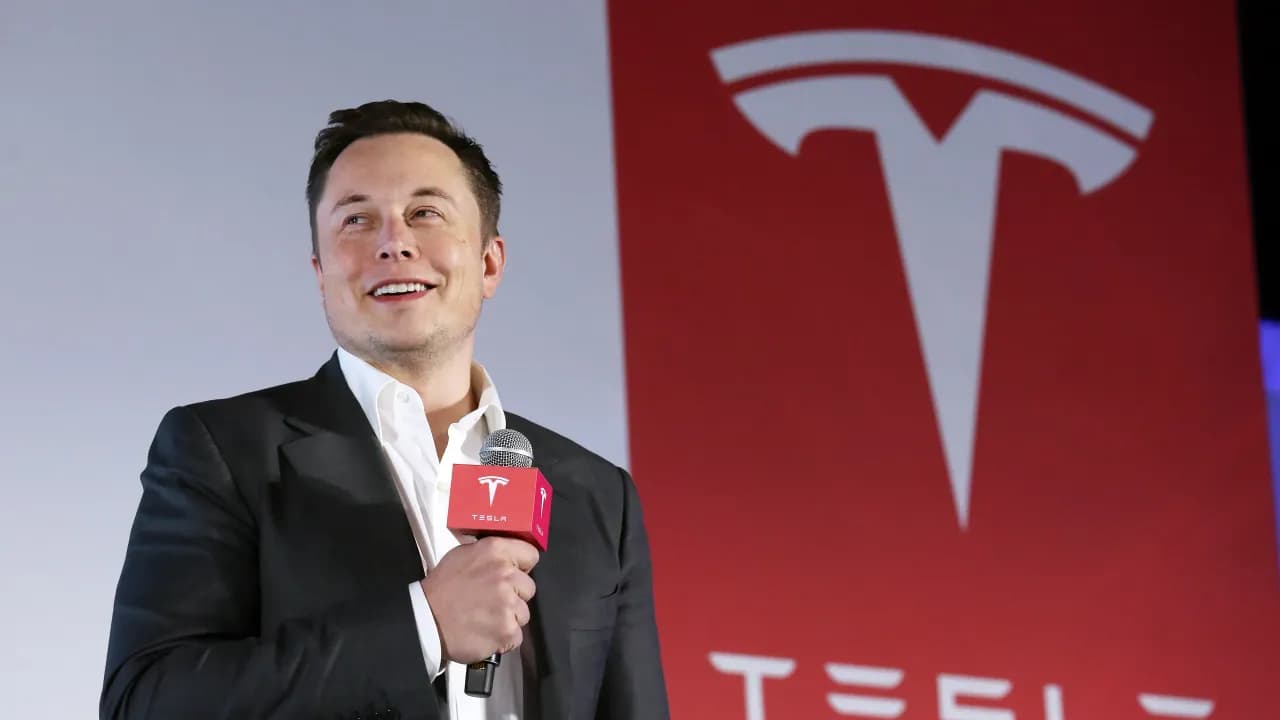

The Future Fund Managing Partner, Gary Black, on Monday stated that he is cautious on Tesla Inc. (TSLA) stock despite the Elon Musk-led company inching closer to solving unsupervised autonomous driving capability.

In a post on X, Black warned that, based on Tesla’s “fairly stretched” price-to-earnings (P/E) multiple of 210 compared to annual long-term earnings growth of 35%, which indicates a PEG ratio of 6, investors are already discounting the company’s progress in unsupervised autonomy.

Tesla shares were up more than 1% in Monday’s pre-market trade. Retail sentiment on Stocktwits around the company trended in the ‘bullish’ territory at the time of writing.

Weak Volumes

Black added that while the Tesla stock has the potential to go higher, his caution is driven by weak fourth-quarter (Q4) volumes for the EV maker.

“While TSLA stock could certainly go higher, we remain cautious given that 4Q EV volumes remain weak following expiration of the $7,500 U.S. EV credit on 9/30,” Black added.

Get updates to this story developing directly on Stocktwits.<

For updates and corrections, email newsroom[at]stocktwits[dot]com.<