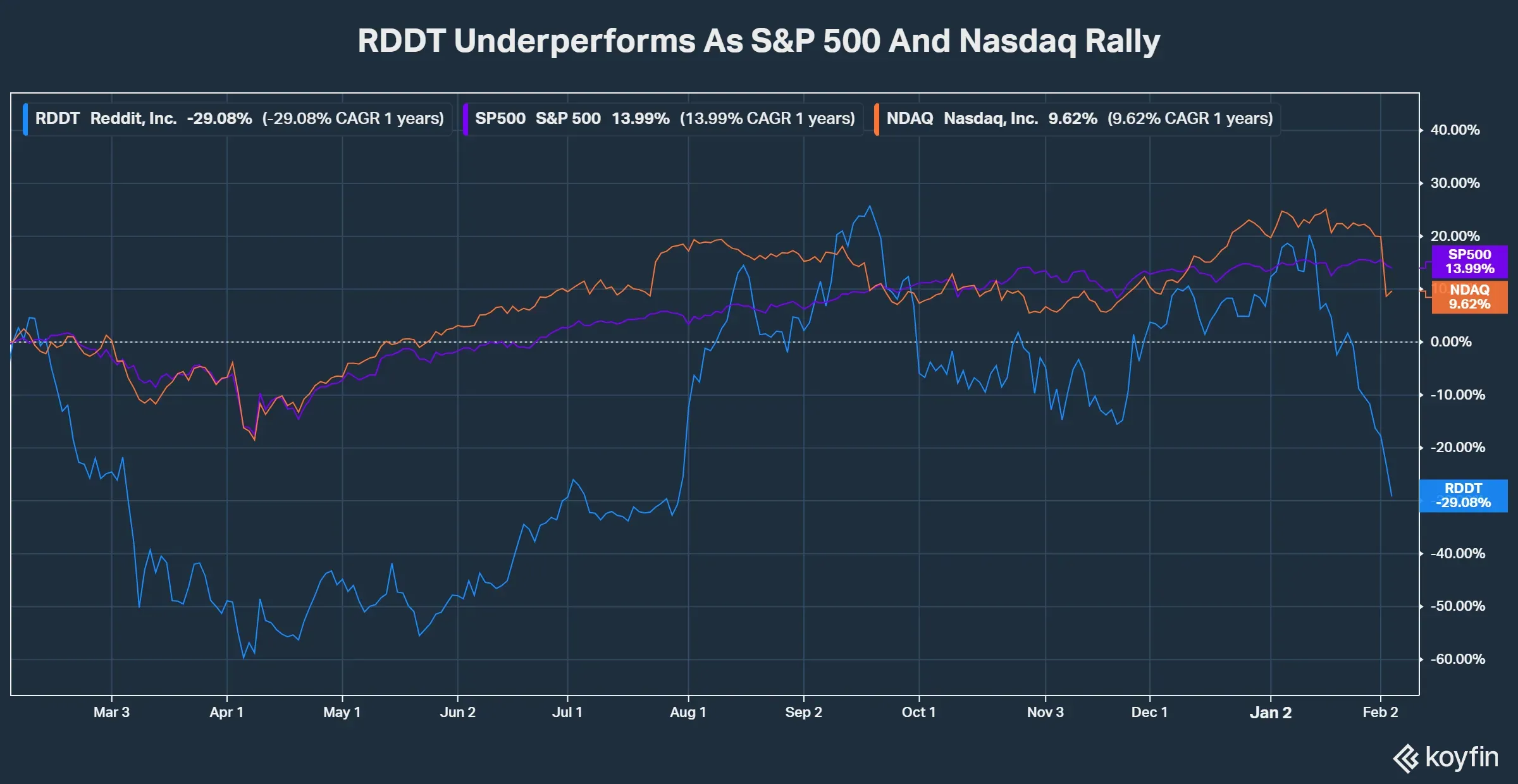

Reddit heads into Q4 earnings with its RSI near 21 and shares down 29% over the past year.

- Reddit heads into Q4 earnings with its RSI near 21 and shares down 29% over the past year.

- 31 analysts are covering the stock on Koyfin and a 12-month average price target implies a 65% upside from its last close.

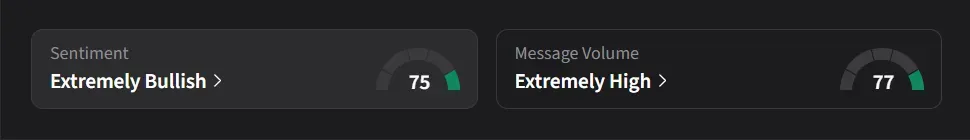

- Retail traders have turned more optimistic ahead of the report, with Stocktwits sentiment flipping to ‘extremely bullish’ from 'bullish' over the past 24-hours.

Reddit heads into its Q4 earnings report under pressure, with technical indicators flashing deeply oversold, leaving investors to look for cues on whether the weakness is technical or fundamental.

Reddit’s Stock Slide Raises Questions Ahead Of Q4

Reddit’s relative strength index has slipped to around 21, placing the stock firmly in oversold territory after a prolonged decline. Over the past 12 months, Reddit shares have fallen about 30%, lagging the S&P 500’s roughly 15% gain and the Nasdaq’s about 10% rise over the same period.

The Wall Street View On Reddit

Roth Capital raised its price target on Reddit in January to $215 from $210 and reiterated a ‘Neutral’ rating. The brokerage expects a “beat and raise” quarter but described itself as a “tactical buyer” following the stock’s recent weakness.

Last month, Deutsche Bank lifted its target to $285 from $255 and maintained a ‘Buy’ rating, pointing to improving fundamentals and longer-term monetization potential. Morgan Stanley also raised its price target to $265 from $250 and reiterated an ‘Overweight’ rating, arguing that the market is likely to reward internet platforms that demonstrate tangible returns from AI-driven investments.

Meanwhile, Evercore ISI initiated coverage with an ‘Outperform’ rating and a $320 target, citing a multi-year revenue growth runway supported by advertising products, new formats, and improving average revenue per user.

Also in January, Wells Fargo raised its target to $207 from $186 and kept an ‘Equal Weight’ rating, saying traffic trends remained soft but onboarding improvements could support logged-in daily active users. Argus lifted its target to $300 from $250 and reiterated a ‘Buy’ rating, citing strong execution and what it described as a promising growth runway. Cantor Fitzgerald also initiated coverage with a ‘Neutral’ rating and a $240 target, saying the stock’s valuation reflects a bullish outlook.

According to Koyfin, Reddit is currently covered by 31 analysts, with a 12-month average price target of $252.39 implying a 65% upside from the stock’s last close.

Insider Sale Adds To Overhang

Investor focus has also turned to insider activity. In an SEC filing from last month, Reddit disclosed that CEO Steve Huffman sold shares worth roughly $3.3 million. The filing showed Huffman exercised stock options and sold multiple tranches of Class A shares at prices between roughly $180 and $190.

What Wall Street Expects From Q4

For the fourth quarter, Wall Street expects Reddit to report revenue of about $667 million, up 14%, from the previous year, alongside EBITDA of around $287 million, up about 21% from the prior quarter, according to Koyfin data. Analysts also forecast GAAP earnings per share of $0.93, representing nearly 16% growth from $0.80 in the previous quarter.

Stocktwits Traders Turn Bullish

On Stocktwits, retail sentiment around Reddit has flipped to ‘extremely bullish’ from ‘bullish’ over the past 24-hours ahead of earnings amid a 24% surge in message volume.

In an ongoing Stocktwits poll, about 79% of users expect Reddit to beat both revenue and earnings in its Q4 report. Another 6% see a beat on earnings but a revenue miss, while 5% expect the opposite outcome. Nearly 10% of respondents see a miss on both revenue and earnings.

One user said, “in hindsight, a while back, when we had the biggest one day drop in three months…that was the canary in the coal mine, for the beginning of our multiple compression.”

Another user described the recent move as a familiar “wash, rinse, repeat” cycle, noting that the market has seen few meaningful corrections since late March amid tariff-related developments, and said pullbacks can sometimes take several months to fully play out, without any guarantee of a rebound.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<