iRobot’s bankruptcy and pending delisting caps the collapse of the Roomba pioneer, which its founder says was “avoidable.”

- Founder Colin Angle said the bankruptcy was “avoidable” and called the outcome a tragedy for consumers.

- iRobot will be taken private by its Chinese lender and supplier, Shenzhen Picea Robotics, while continuing normal operations.

- The collapse follows the failed Amazon acquisition and years of pressure from cheaper rivals and rising debt.

iRobot shares dropped more than 10% in after-hours trading on Monday after Nasdaq notified the company that it will delist its common stock following the Roomba maker’s Chapter 11 bankruptcy filing. Trading in the shares will be suspended at the open on Dec. 22, and the company said it does not plan to appeal the decision.

Shares Sink, Founder Speaks Out

The delisting notice follows a brutal selloff in iRobot shares, which plunged nearly 73% in the regular session on Monday, marking the stock’s worst day on record. Colin Angle, iRobot’s co-founder and former chief executive, said the bankruptcy was “avoidable” and described the collapse as “nothing short of a tragedy for consumers,” as well as for the robotics industry and the U.S. innovation economy, according to a CNBC report.

Bankruptcy And Takeover

Over the weekend, iRobot said it filed for Chapter 11 protection and will be acquired by its Chinese contract manufacturer and lender, Shenzhen Picea Robotics. The company said it will continue normal operations under Picea’s ownership, and that consumers should see no disruption to their Roomba devices, apps, or customer support.

Court filings show iRobot listed between $100 million and $500 million in assets and liabilities, including nearly $100 million owed to Picea, along with other outstanding obligations.

Amazon Deal Fallout

Angle said the collapse followed the failure of Amazon’s planned $1.7 billion acquisition, which he has described as iRobot’s most viable path to compete globally. Amazon abandoned the deal in 2024 after regulatory scrutiny in the U.S. and Europe, paying a breakup fee. In the aftermath, iRobot cut staff, took on additional debt, and struggled as lower-cost competitors gained ground.

End Of A Category Pioneer

Founded in 1990 by MIT researchers, iRobot launched the Roomba in 2002 and went on to sell about 50 million robots, with the brand becoming synonymous with robot vacuums. A brief rally in recent weeks had raised hopes of a turnaround, but the bankruptcy filing and pending delisting effectively end the company’s 35-year run as an independent, publicly traded robotics pioneer.

CEO Gary Cohen said the restructuring is aimed at securing iRobot’s long-term future as a private company under Picea’s ownership, even as the company exits the public markets.

How Did Stocktwits Users React?

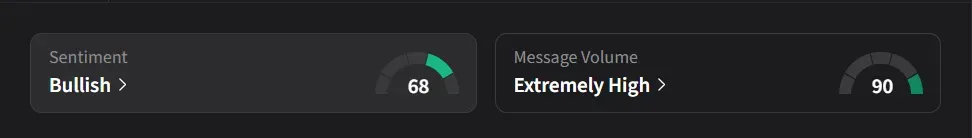

On Stocktwits, retail sentiment for iRobot was ‘bullish’ amid ‘extremely high’ message volume.

One user said markets focus on winners, but iRobot’s sharp decline over the past four years shows how quickly even well-known companies can falter.

Another user said, “Management should never be allowed to work in this capacity ever again! Pathetic results!”

iRobot’s stock has declined 85% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<