synopsis

Asian markets closed mostly lower on Thursday, led by Japan’s Nikkei 225 Index, which plunged 2.77% before settling at an eight-month low, while European stocks started sharply lower.

President Donald Trump’s reciprocal tariffs announced late Wednesday appear to have taken the wind out of the sails of the market, which was already teetering on the brink of the correction territory.

The Asian markets closed mostly lower on Thursday, led by Japan’s Nikkei 225 Index, which plunged 2.77% before settling at an eight-month low. The new tariff rate applicable to imports from Japan is 24%.

The U.S. is set to levy tariffs of 34% on China and 32% on Taiwan, two nations where the bulk of the U.S. tech giants’ supply chain is located.

While the Chinese market showed muted reaction, the Taiwanese market remained closed for a public holiday and is set to reopen only on Monday.

European stocks have also opened sharply lower following a 20% tariff announced by Trump for imports from the European Union.

The WTI-grade crude oil futures plunged over 3% and the safe haven gold also fell, although modestly.

In the currency market, the dollar is weaker across the board against its major counterparts, reflecting concerns about a potential recession in the country.

The yield on the 10-year U.S. Treasury fell nearly 2.75% to $4.080, the lowest since October 2024.

Early Thursday, the major U.S. index futures plummeted, with the Dow Jones futures down about 2.25%, the S&P 500 futures slumped over 2.80% and the Nasdaq 100 futures plunged over 3%.

Small-cap stocks may also face the heat, with the Russell 2,000 futures down a steeper 3.80%.

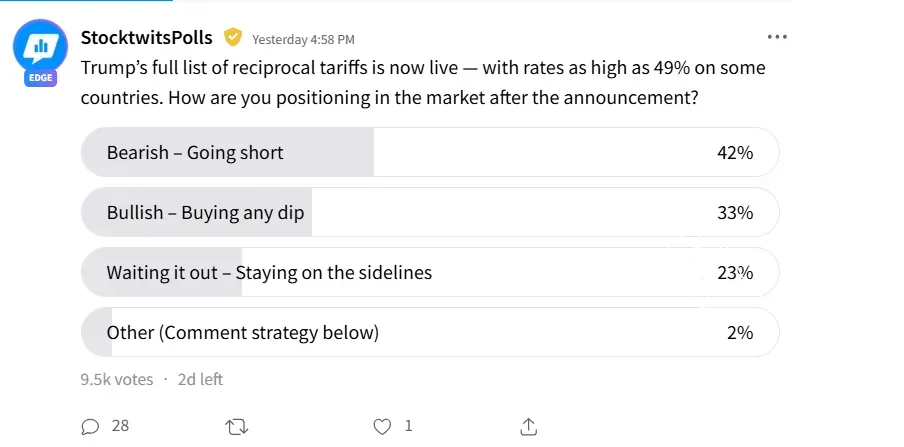

Retail trades were skittish amid the development. An ongoing Stocktwits poll that has so far collected 9,500 responses showed that most (42%) looked to short stocks. On the other hand, 33% said they were bullish and would look to buy the dip.

Those who were willing to wait it out, staying on the sidelines, made up 23% of the total respondents.

Those bearish and those stepping to the sidelines made up about two-thirds of respondents.

One of the respondents said they were already hedged for a "catastrophic crash.”

Another user, however, looked at the brighter side of things. They saw the volatility as a good opportunity for swing and day trading.

The SPDR S&P 500 ETF Trust (SPY), an exchange-traded fund (ETF) that tracks the broader S&P 500 Index, and the Invesco QQQ ETF (QQQ) that tracks the Nasdaq 100 Index, were among the top five trending tickers on Stocktwits.

The SPY ETF fell 2.78% at $548.81 in Thursday’s premarket session and the QQQ ETF was down 3.01% at $461.81.

The CBOE Volatility Index, commonly called VIX, spiked by 18.89% to $25.56, the highest since mid-March.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

)

subscribe to Asianet News Whatsapp channel by clicking here.

subscribe to Asianet News Whatsapp channel by clicking here.