Ethereum’s price remained below $2,000, with analysts warning that the risk of a deeper correction increases if the token fails to reclaim that level soon.

- Investors are awaiting U.S. CPI data, which could influence the Fed’s stance on interest rate cuts due in March.

- Headline and core CPI are projected to rise 0.3% month over month and 2.5% year over year.

- Analyst Ted Pillows said prolonged weakness below key technical levels increases the probability of further downside.

Crypto markets hunkered down in a tight range Friday morning ahead of the inflation readings later in the day that could snap Bitcoin (BTC) back from its $66,000 ledge or push it lower.

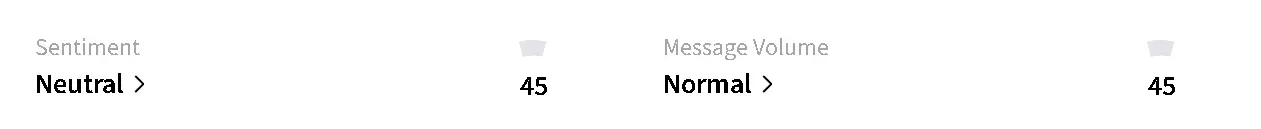

Bitcoin’s price was trading at around $66,800, down 0.7% in the last 24 hours, but remaining above the $66,000 mark that many fear will give way to a deeper correction. On Stocktwits, retail sentiment around the apex cryptocurrency fell to ‘neutral’ from ‘bullish’ territory over the past day, and chatter dipped to ‘normal’ from ‘high’ levels.

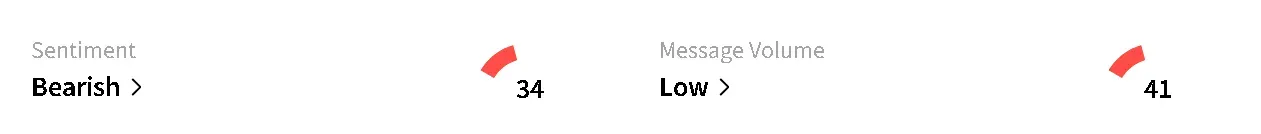

Analysts are keeping an eye on Ethereum (ETH) as well, which has been unable to climb back above the $2,000 mark. Ethereum’s price was trading around $1,961, down 0.8% in the last 24 hours. On Stocktwits, retail sentiment around the leading altcoin remained in ‘bearish’ territory over the past as chatter dipped to ‘low’ from ‘normal’ levels.

According to MarketWatch data, both the consumer price index (CPI) and the core CPI are expected to gain 0.3% over the last month, with a 2.5% increase year-on-year. The hotter-than-expected reading would slash hope for an interest rate cut in March, while in-line or lower-than-expected inflation numbers would boost sentiment.

What Are Retail Users Saying?

One hopeful user on the platform said that the V-shaped recovery forecast by Bitmine Immersion Technologies’ (BMNR) Tom Lee will likely be the turning point. According to Lee, the “perfect bottom” awaits Ethereum’s price at around $1,890.

Another user noted that the AI agents replacing parts of the traditional software-as-a-service (SaaS) sector would be a bullish move for Ethereum.

According to analyst Ted Pillows, the longer Ethereum takes to get back above $2,000, the higher the odds of a deeper correction. The same goes for Bitcoin, with its price remaining above $66,000, and if BTC’s price rises above $70,000, it could signal a larger rally ahead.

Solana’s Price Slips Below $80

The overall cryptocurrency market dipped by around 1% over the last 24 hours, keeping it above the $2.3 trillion mark. Dogecoin (DOGE) was the only crypto major in the green on Friday morning, up 0.6% in the last 24 hours.

Solana (SOL) was the worst hit among the top 10 cryptocurrencies by market capitalization. SOL’s price fell 2.4% in the last 24 hours to under $80. Binance Coin (BNB) also dropped more than 2%, holding just above $600.

Read also: Bitcoin Unlikely to Deliver 500x Returns, Grayscale Chairman Says – But These 2 Privacy Tokens Could Outperform

For updates and corrections, email newsroom[at]stocktwits[dot]com.<