Bloomberg analyst warned that the increasing number of crypto ETF launches may lead to the closure of weaker products by 2027.

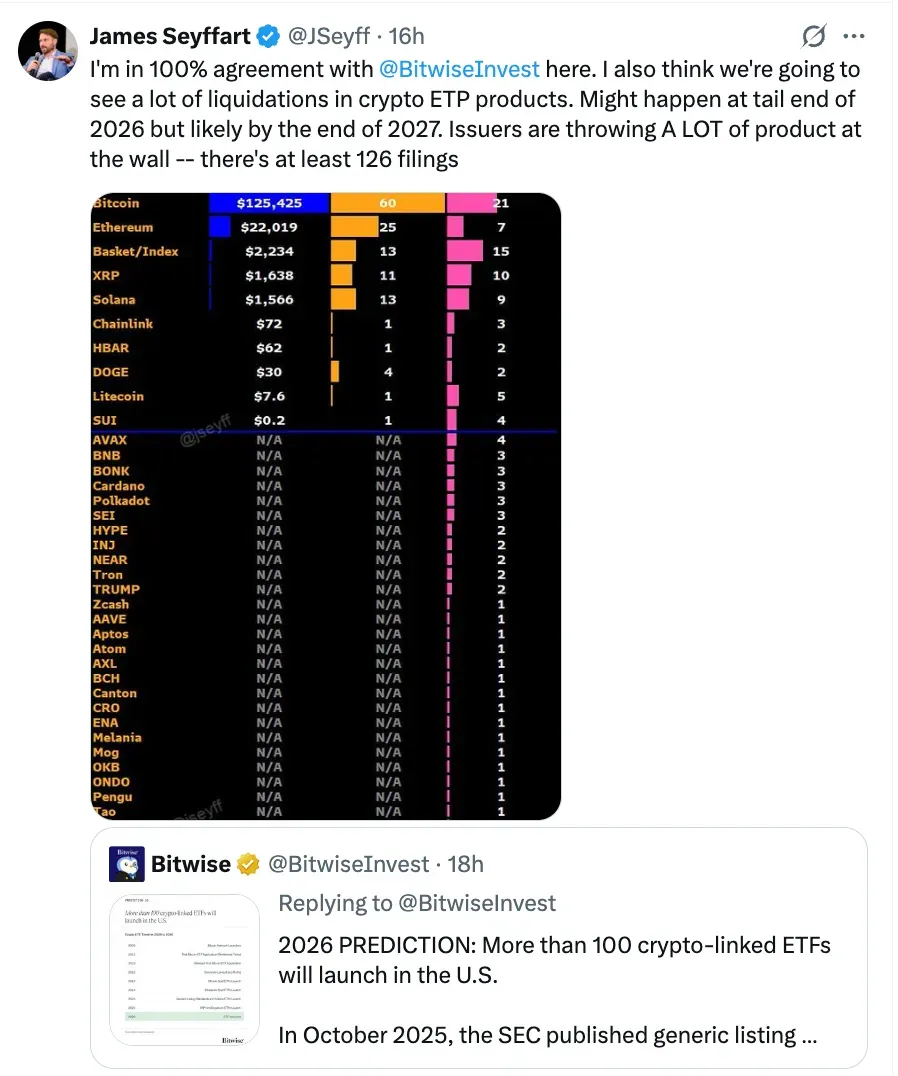

- James Seyffart of Bloomberg Intelligence predicts a crypto ETP fallout by late 2026–2027, warning that many of the 126 submitted products may fail as competition rises.

- Bitwise said that in 2026, there will be a "ETF-palooza," with more than 100 new crypto-linked ETFs set to launch in the U.S.

- U.S. spot Bitcoin ETFs currently hold about $112.5 billion in net assets, making up about 6.6% of Bitcoin's market cap.

Bloomberg Intelligence ETF analyst James Seyffart warned on Wednesday that the fast-growing cryptocurrency exchange-traded product (ETP) market is likely heading toward a wave of closures by late 2026 or 2027.

Responding to a post by crypto asset manager Bitwise on X, Seyffart said that while some consolidation may begin as early as late 2026, the bulk of liquidations could occur by the end of 2027, as competition intensifies and weaker products fail to attract investor flows.

“With at least 126 crypto ETP filings already in play, many of these products simply won’t survive once the market becomes more crowded,” Seyffart said, adding that a shakeout is inevitable as issuers compete for limited capital.

Crypto ETFs Under Pressure

Crypto exchange-traded products (ETPs) include ETFs as a major subgroup, meaning current ETF flows are a good indicator of which crypto-linked vehicles are finding traction—and which may struggle to survive as competition heats up.

According to SoSoValue data, U.S. spot Bitcoin ETFs saw about $112.5 billion in net assets as of early December 2025. This is about 6.6% of Bitcoin's overall market value. Fidelity's FBTC (FBTC) brought in $391 million on its own, which was the most recent net inflow of $457 million for the products. In contrast, spot Ethereum ETFs lost $22.43 million, while Solana and XRP spot ETFs gained only $10.99 million and $18.99 million, respectively.

Bitcoin (BTC) was trading at $86,728, slipping only 0.01% in the last 24 hours. On Stocktwits, retail sentiment around Bitcoin remained in ‘extremely bearish’ territory, accompanied by’low’ levels of chatter over the past day.

Bitwise said in a separate forecast released Wednesday that more than 100 crypto-linked exchange-traded funds will launch in the U.S. in 2026 alone. The firm described the coming year as an “ETF-palooza,” driven by an expected surge in regulatory approvals.

New SEC Standards Clear Path For Crypto ETFs

Seyffart’s forecast comes amid the U.S. Securities and Exchange Commission’s (SEC) positive approach towards the crypto industry under Chair Paul Atkins. In September, the SEC released new general listing rules for spot crypto ETFs, which eliminated the requirement for individual 19(b) filings for qualifying funds, as per the official press release. The adjustment cut approval times significantly, creating a path for a flood of new crypto ETP launches.

Read also: Three Years After FTX Collapse, SEC Finally Issues Guidance On Custody Of Crypto Assets

For updates and corrections, email newsroom[at]stocktwits[dot]com.<