Coinbase said stock trading will be integrated into existing user accounts alongside crypto and cash.

- At the ‘System Update’ event Coinbase said its new stock trading feature allows users to transact using balances held on the platform, including USD Coin.

- Coinbase also announced that it has partnered with Kalshi to power its prediction markets, mirroring a step Robinhood took earlier this year.

- The announcement comes amid broader efforts by traditional brokerages to integrate crypto and tokenized assets.

Shares of Coinbase (COIN) rose in after-hours trading on Wednesday after the crypto exchange announced plans to roll out stock trading on its platform, expanding beyond cryptocurrencies during its ‘System Update’ product event.

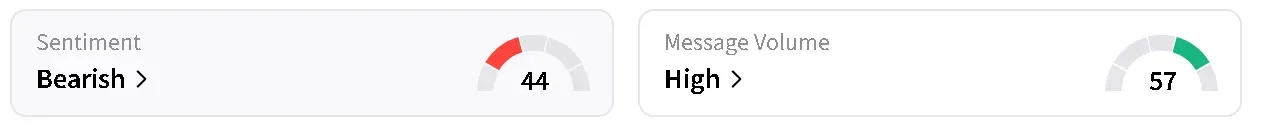

COIN’s stock gained more than 1.5% in after hours trade after dropping more than 3% in regular trading. On Stocktwits, retial sentiment around the company remained in ‘bearish’ territory over the past day, as chatter rose to ‘high’ from ‘normal levels.

The move positions Coinbase more directly against platforms that already combine equity and crypto trading, while expanding its role from a crypto-native exchange toward a broader retail investing hub.

Coinbase Pushes Into Stock Trading

Coinbase executives said stock trading will be integrated directly into existing user accounts, allowing customers to manage equities, crypto, and cash within a single interface.

“Stock trading is now available on Coinbase,” said Max Branzburg, the company’s head of consumer products, during the event. “You only need one account.” He added that users will be able to buy stocks using their existing Coinbase accounts funded with USD Coin (USDC), offering “one portfolio view, one wallet, one transaction history.”

USDC issuer Circle’s (CRCL) stock was up 0.8% in afterhours trade after falling more than 4.5% during regular trading. Retail sentiment around the stock remained in ‘bearish’ territory amid ‘low’ levels of chatter.

Prediction Market Play

Robinhood (HOOD) already offers both crypto and stock trading on its platform. However, the announcement did not seem to put a damper on HOOD’s stock, which rose around 1.5% in after hours trade after closing the day 3% lower.

Coinbase also announced that it has partnered with Kalshi to power its prediction markets, following Robinhood’s lead, which announced a similar partnership earlier this year.

The Winklewoss twins-led Gemini (GEMI) crypto exchange also announced prediction market trading earlier this week. GEMI’s stock edged 0.3% higher in after hours trade after plummeting 8.75% in regular trading on Wednesday. Retail sentiment around the company fell to ‘bullish’ from ‘extremely bullish’ as chatter dropped to ‘high’ from ‘extremely high’ levels over the past day.

One user on the platform noted that Gemini operates under its own prediction market license, while Coinbase is using Kalshi’s license for order distribution, a distinction that could matter for long-term strategy.

Another said they prefer platforms such as SoFi Technologies (SOFI), citing the absence of trading fees.

SOFI’s stock fell nearly 5% on Wednesday, moving 0.47% higher in after hours. Retail sentiment around the company on Stocktwits remained in ‘bearish’ territory over the past day, accompanied by ‘low’ levels of chatter.

Traditional Finance Moves Toward Crypto

Coinbase’s announcement comes amid broader efforts by traditional brokerages to integrate crypto and tokenized assets. Morgan Stanley (MS) plans to introduce spot crypto trading on its ETrade platform in the first half of 2026, working with infrastructure provider Zerohash.

Traders are also watching Coinbase’s international strategy. India’s Competition Commission recently approved Coinbase’s acquisition of a minority stake in CoinDCX, signaling renewed engagement with one of the world’s fastest-growing crypto markets.

In the U.S., the Securities And Exchange Commission (SEC) issued fresh guidance on Wednesday to outline how registered broker-dealers can custody and trade crypto assets.

Read also: Bitcoin, Ethereum ETFs See Over $500M Outflows While XRP And Solana Funds Buck The Sell-Off

For updates and corrections, email newsroom[at]stocktwits[dot]com.<