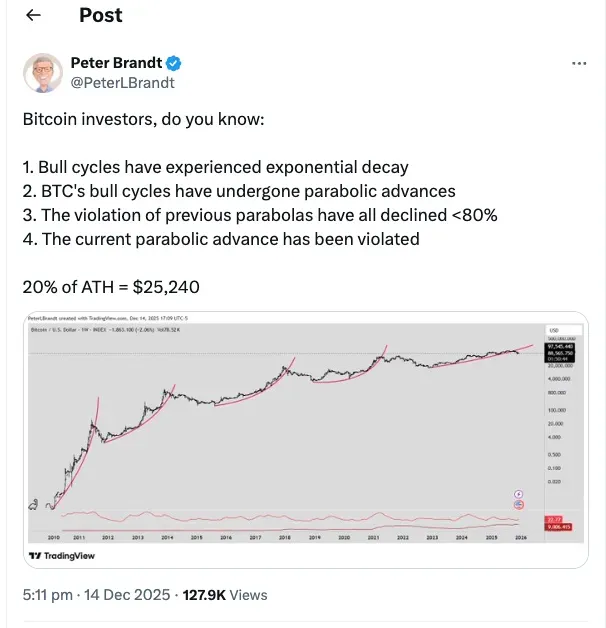

In a post on X, Peter Brandt said Bitcoin is exhibiting “exponential decay,” meaning each rally yields smaller percentage gains as it matures.

- While bull cycles still turn parabolic, Bitcoin gains have shown exponential decay as the asset matures, Brandt warned.

- He stated that the current parabolic structure has been broken, indicating a possible deeper correction.

- Past Bitcoin cycles support this pattern, with peak-to-trough declines easing from 94% in 2011 to 77% in 2021-2022.

Veteran trader Peter Brandt on Sunday warned that Bitcoin’s (BTC) latest price formation may signal greater downside risk, which could take the apex cryptocurrency’s price as low as $25,000.

In a post on X, macro trader Brandt pointed to a historical pattern in Bitcoin’s bull-market cycles showing "exponential decay," meaning that as the asset matures, each rally yields a smaller percentage gain.

Bitcoin’s price was trading at around $89,784 on Monday morning, down 0.3% in the last 24 hours. On Stocktwits, the apex crypto remained in ‘bearish’ territory, with ‘low’ levels of chatter over the past 24 hours.

Where Is Bitcoin’s Bottom?

Even though things have slowed down, he said that Bitcoin has still tended to move in parabolic patterns during bull phases, which are sharp, fast moves that eventually break. According to Brandt, past infractions of these parabolic trends have consistently resulted in drops of less than 80% of the cycle peak.

He stated that the current parabolic trend has been violated, suggesting that a deeper corrective phase, based on historical analogs, may be underway.

Using Bitcoin's most recent all-time high of over $126,000, reached in early October, as a benchmark, Brandt said an 80% decline would indicate a potential downside level of around $25,240, or roughly 20% of the peak price.

He presented this figure not just as a prediction for Bitcoin’s price, but based on historical cycles.

Bitcoin’s Historical Performances

Bitcoin peaked near $32 in 2011 and then fell to around $2, marking a 94% loss. This early cycle is often regarded as an outlier given Bitcoin's extremely small market size and low liquidity at the time.

However, in the 2013-2015 cycle, after peaking around $1,150 in late 2013, Bitcoin fell to near $150 in early 2015, representing an approximately 87% drop from the peak.

In 2018, Bitcoin fell from its 2017 high of around $19,800 to around $3,200, a loss of approximately 84%. Furthermore, in the 2021-2022 cycle, Bitcoin peaked near $69,000 in November 2021 and then fell to around $15,500 in November 2022, a 77% drop that was noticeably shallower than previous cycles.

Read also: ‘Solana Is Bitcoin 3.0’ – CIO Of Europe’s Oldest Crypto Fund Calls BTC ‘Unusable’ In Comparison To SOL

For updates and corrections, email newsroom[at]stocktwits[dot]com.