The last time Changpeg ‘CZ’ Zhao posted “Poor Again” was during the 2022 crypto slump when Bitcoin’s price fell from $67,000 to around $30,000.

- CryptoQuant highlighted the risk of prolonged time-based capitulation rather than sharp price declines alone.

- Michael van de Poppe pointed to historically low RSI levels seen only during major market stress events.

- Plan C said multiple long-term indicators suggest Bitcoin may be approaching a bottom, with support between $54,000 and $58,000.

Binance (BNB) founder Changpeng ‘CZ’ Zhao posted a familiar crypto throwback on Thursday amid Bitcoin’s (BTC) to slide to $60,000, while analysts flagged worrying technical indicators to past crypto winters.

“Poor again,” CZ wrote in a post on X, noting that the last time he used this phrase was during Bitcoin’s drop from $67,000 to roughly $30,000, during the 2022 crypto slump.

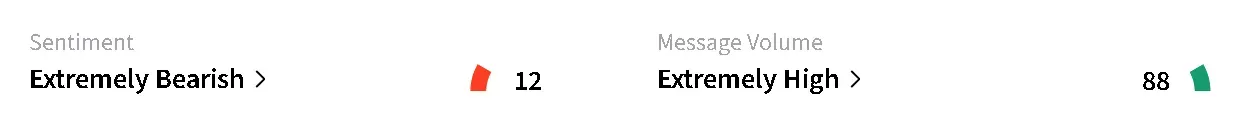

Bitcoin’s price recuperated to around $65,100 on Thursday night, still down 8.5% in the last 24 hours. On Stocktwits, retail sentiment around the apex cryptocurrency dropped lower within the ‘extremely bearish’ zone with chatter steady at ‘extremely high’ levels over the past day. BTC’s price is now nearly 50% lower than its record high of over $126,000 seen in October last year.

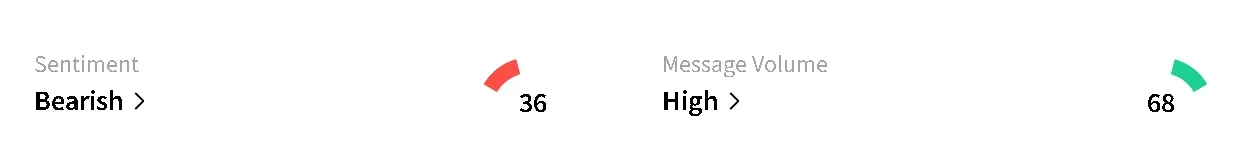

Meanwhile, BNB’s price posted double-digital losses, down 10.6% in the last 24 hours to $623.12. The cryptocurrency has fallen nearly 55% from its record high over $1,300 seen in October. On Stocktwits, retail sentiment around the altcoin fell to ‘bearish’ from ‘neutral’ territory over the past day with message volume at ‘high’ levels.

Analysts Warn Capitulation May Be Underway

Several analysts pointed to technical signals suggesting the market may be entering a capitulation phase. CryptoQuant noted that the larger risk at this stage of Bitcoin's fall may be “time capitulation” rather than additional price declines. According to the firm, the danger lies not only in how far prices fall, but in how long they remain depressed.

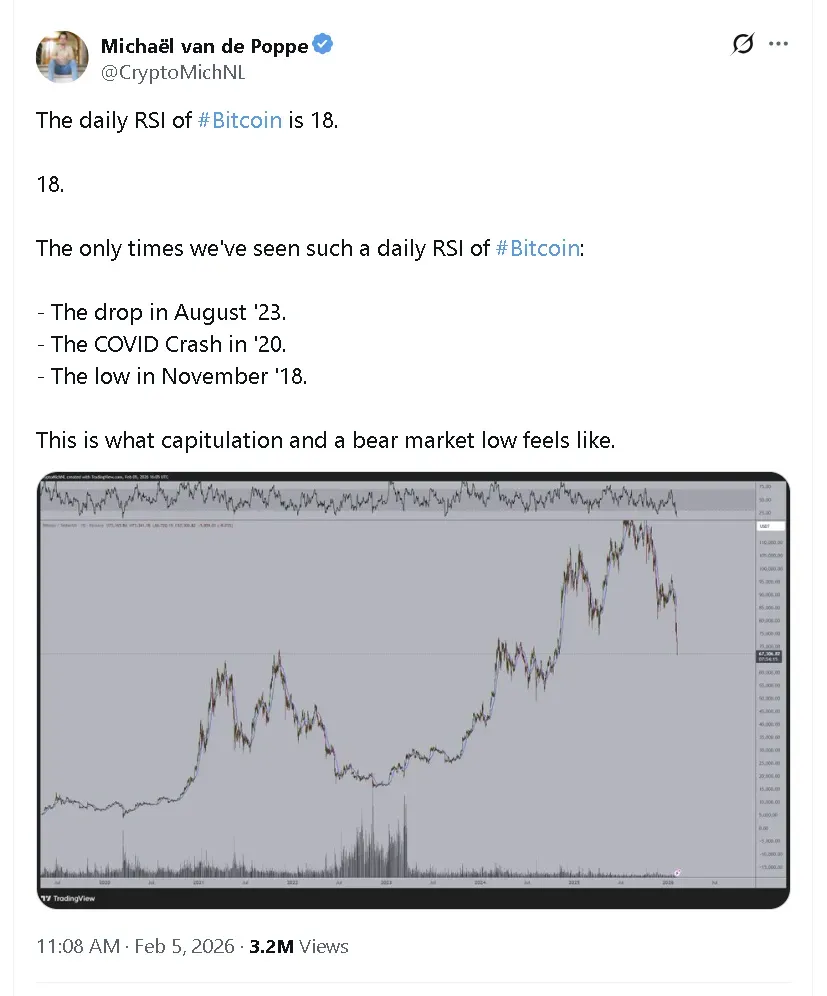

MN Fund founder and chief investment officer Michael van de Poppe pointed to Bitcoin’s daily relative strength index (RSI), which recently fell to 18. He said such levels have only appeared during a handful of major stress events, including the COVID crash in 2020, the market low in November 2018, and the sharp selloff in August 2023. Van de Poppe described the reading as characteristic of capitulation and conditions typically seen near bear market lows.

Analyst who goes by Plan C stated on X if Bitcoin’s weekly RSI were to close at current levels, it would match the lowest reading in the asset’s history. He pointed to the 200-week simple moving average near $58,000 and estimated potential support between $54,000 and $58,000. While acknowledging strong downside momentum and limited buying support so far, he said multiple indicators suggest the market may be approaching a bottom.

Read also: Bitcoin’s Slide Triggers MSTR’s Biggest One-Day Drop In Over A Year – But These Three Crypto Stocks Took a Bigger Hit

For updates and corrections, email newsroom[at]stocktwits[dot]com.<