Free UPI Has Delivered Benefits, But Costs Must Be Covered: RBI Governor

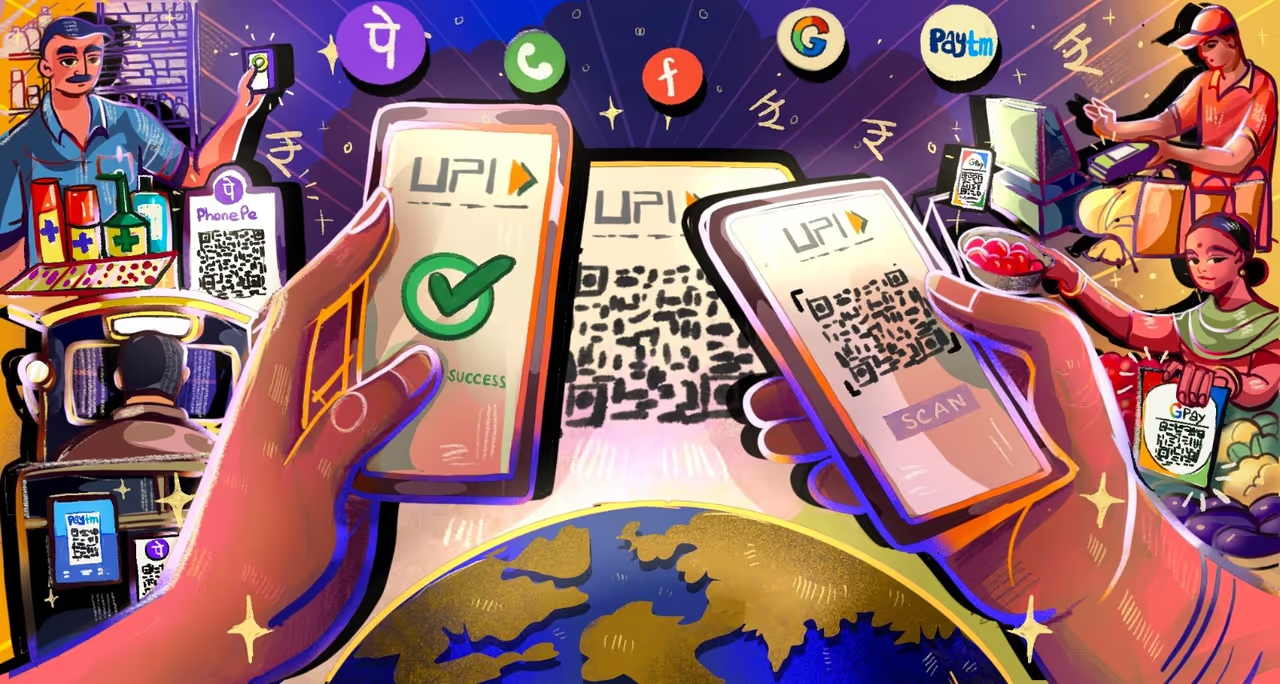

Amidst talks of instant merchant UPI payments, RBI Governor Sanjay Malhotra stated that for the payment system to be sustainable, its operational costs must be borne by either the government or the users.

UPI Transaction Fee

MDR and Government Subsidies for Payments

UPI transactions

Incentive scheme

The government's outlay under the incentive scheme for UPI transactions rose from Rs 957 crore in 2021-22 to Rs 3,268 crore in 2023-24. The revised estimate for total payment under the scheme in 2024-25 was Rs 2,000 crore, while Rs 437 crore has been budgeted for 2025-26.

MDR and Government Subsidies for Payments

Stay updated with all the latest Business News, including market trends, Share Market News, stock updates, taxation, IPOs, banking, finance, real estate, savings, and investments. Track daily Gold Price changes, updates on DA Hike, and the latest developments on the 8th Pay Commission. Get in-depth analysis, expert opinions, and real-time updates to make informed financial decisions. Download the Asianet News Official App from the Android Play Store and iPhone App Store to stay ahead in business.