synopsis

Dezerv Investments Private Limited highlights how Trump’s tariff threats could stir global volatility but create long-term investment opportunities for India across equities, debt, and gold.

As US President Donald Trump reignites his trademark protectionist trade policies with fresh tariff threats, global markets are bracing for another round of uncertainty. However, according to the latest house view from investment firm Dezerv Investments Private Limited, Indian investors may have less to fear and more to gain from this geopolitical shake-up.

In a report titled 'Dark Clouds, Strong Silver Linings - What Trump's Tariff Actions Mean For Your Investment', Dezerv offers a comprehensive assessment of how Trump’s aggressive tariff stance—intended to reduce the US trade deficit through reciprocal duties—might impact global markets and, more importantly, India’s economy and investment landscape.

Global Jitters, Local Opportunities

Trump’s renewed tariff rhetoric targets major US trade partners, including China, India, and the European Union. The firm notes that while near-term volatility is likely—particularly in export-heavy sectors—India’s relatively insulated economy, driven largely by domestic consumption and capex (capital expenditure), positions it favorably.

"Trump’s tariff threats may cast short-term shadows, but there are strong silver linings for long-term investors, especially in India," the report notes.

"Trump’s proposed tariffs are aimed at balancing US trade deficits via reciprocal duties. Near-term volatility is expected across global markets, especially in US-export-heavy sectors," it added.

Indian equities, less reliant on exports compared to peers, are expected to be less volatile. Furthermore, the country stands to benefit from global supply chain diversification, especially under the prevailing “China +1” strategy adopted by many multinationals.

"Indian equities depend heavily on domestic consumption and capex, hence may see lower volatility. Interest rates are likely to decline. Gold may continue to be a safe - haven for investors," it noted.

India–US Trade Snapshot: A Surplus at Stake

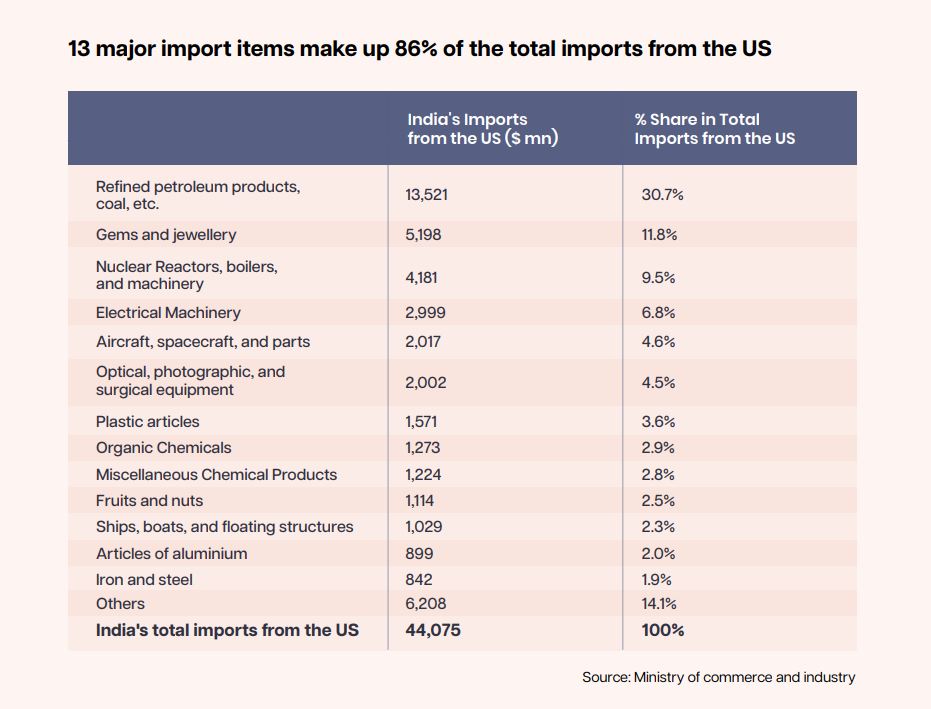

India currently enjoys a trade surplus of $36.7 billion with the United States, exporting $80.8 billion worth of goods while importing $44.1 billion. Major exports include:

-

Electrical Machinery (15.6%)

-

Gems & Jewellery (11.5%)

-

Pharmaceuticals (11%)

On the import side, India sources a significant chunk of refined petroleum, machinery, and high-end equipment from the US.

Though India’s trade surplus is modest compared to China or the EU, its industries like IT, pharma, and textiles are vulnerable to any US-led trade deceleration. The report flags specific concerns for IT services, which face headwinds from rising US onshore hiring, tightening visa norms, and widespread AI adoption.

Risks Ahead for India

1. IT and Services – Automation, AI, and stricter US immigration rules are undermining India’s traditional IT-BPM strengths.

2. Export-Driven Industries – Sectors like pharma, auto parts, and gems could be impacted if US demand slows.

3. Global Trade Slowdown – A general drop in industrial goods demand could nudge India’s GDP slightly downward.

4. Dumping Risk – Countries like China and Vietnam may reroute their surplus to India, intensifying local market pressure.

5. Rising Competition – Liberalised trade policies could challenge Indian SMEs as global players gain market share.

Silver Linings for Investors

Despite global turbulence, Dezerv identifies multiple macroeconomic and structural positives in India:

-

Resilient Consumption – A steady domestic demand base is expected to anchor economic stability.

-

Attractive Valuations – Recent market corrections have brought valuations to more reasonable levels.

-

Rate Cut Cycle – With inflation stable and interest rates high, India may enter a rate-cutting phase—potentially reviving capital inflows.

-

Softening Commodity Prices – Lower input costs could bolster consumer spending and corporate margins.

-

“China +1” Advantage – India continues to gain from companies shifting manufacturing bases away from China.

Also read: Tariff titans: India and the US face off in a high stakes trade dance | Opinion

Sectoral Investment Outlook

Equity: Dezerv projects moderate equity returns of 8-12% for FY26. Sectors linked to domestic demand—such as cement, building materials, banking, and FMCG—are tipped to outperform. Export-dependent segments like IT and auto components may lag.

The firm prefers active fund management, believing it is better suited for navigating the current sectoral divergence. Their Equity Revival Strategy is overweight on large-cap equities with a focus on quality businesses and sustainable earnings.

Fixed Income: Amid global slowdown concerns and likely rate cuts, Dezerv remains bullish on fixed income. Their Dynamic Debt Plus Strategy focuses on high-quality bonds with a mix of accrual and select credit opportunities to lock in yields while maintaining liquidity.

Gold: Given ongoing geopolitical risks and currency volatility, gold continues to be a favored hedge. Dezerv recommends a 5% portfolio allocation via its Currency Hedge Strategy.

Deployment Strategy: A Balanced Approach

For new investors, Dezerv advises a staggered approach:

- Equity: Deploy 55% upfront, and the remaining 45% over the next three months.

- Fixed Income: Invest the full allocation immediately to lock in high yields.

- Gold: Immediate deployment of 5% of total portfolio allocation.

)

subscribe to Asianet News Whatsapp channel by clicking here.

subscribe to Asianet News Whatsapp channel by clicking here.