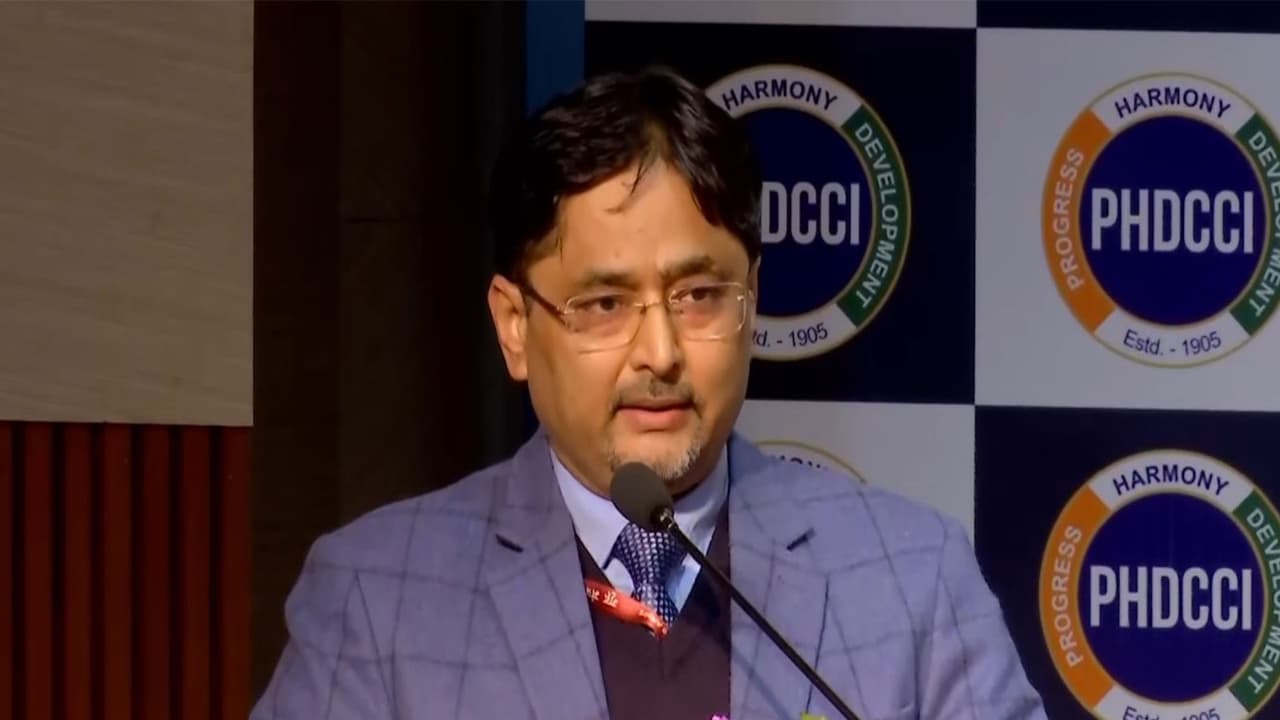

Revenue Secretary Arvind Shrivastava stated that post-Budget tax reforms will only succeed if industry acts as an 'equal partner' in implementation, ensuring policy intent translates into real experience at the grassroots level.

India's post-Budget tax and process reforms will succeed only if industry acts as an equal partner in implementation, not merely as a cooperating stakeholder, and the government wants policy intent to translate into real experience at the grassroots level, Revenue Secretary Arvind Shrivastava said today.

"We want the industry not just to cooperate, but to become and believe that it is an equal partner in the process," Shrivastava said while addressing the PHD Chamber of Commerce and Industry's (PHDCCI) post-Budget session in New Delhi.

Empowering Taxpayers with New Reforms

Shrivastava said the purpose of such engagements was to ensure that the vision and objectives behind Budget decisions were not only communicated clearly but also implemented "in the same spirit", so that outcomes on the ground reflect policy intent. He said many Budget announcements, particularly those related to processes, collectively revisit the architecture of how taxpayers--individuals and businesses--interact with the tax department.

Flexible Filing and Updated Returns

"The thought process behind many of these changes is that the taxpayer... can be in control of his own affairs, while minimising the need for validating his actions through a decision or a process by the department," he said. He pointed to reforms in income tax return filing and post-filing procedures, including a three-month extension for revising returns. The extension, he said, was not mechanical but substantive, allowing taxpayers time to "pause, review", and correct mistakes calmly, thereby reducing the risk of future disputes and departmental engagement.

Shrivastava highlighted the updated return window introduced earlier, which allows taxpayers to update returns for several years after filing. This year's Budget has expanded the facility further by allowing updates even when reassessment proceedings are underway.

"You are not dependent on the procedures and approvals by the department, but are in a position to autonomously take a decision for yourself," he said.

He said these trust-based measures were backed by data. About 1.22 million taxpayers used the updated return window to voluntarily pay around Rs 13,500 crore, despite there being no proceedings or orders against them. "These are people who decided to just come clean, pay up and move forward," he said.

Streamlining Assessment and Penalty Orders

To enhance transparency and reduce disputes, Shrivastava said assessment and penalty orders will now be issued together, clearly indicating whether a case involves under-reporting or misreporting, along with settlement options to enable closure without prolonged litigation.

Reforming Indirect Taxes

On indirect taxes, Shrivastava said the Budget aims to shift from transaction-level scrutiny to an entity-based trust model. He cited existing systems such as Authorised Economic Operators (AEOs) and proposed expanding the concept to trusted manufacturers, importers, exporters and warehouses using audits, digital monitoring and risk-based flags.

"Can we convert transactional engagement into something where we consider entities at the entity level?" he said. He said similar principles would apply to customs warehouses to reduce procedural delays and logistics costs, while creating incentives for businesses to maintain a trusted status.

A Focus on Simplicity and Certainty

Shrivastava also said tax policy should not become a deterrent to business models. Under the simplified tax regime, the government aims to minimise deductions and exemptions to reduce complexity and disputes, while providing tax certainty in areas such as data centres, electronics manufacturing and toll manufacturing to avoid risks of double taxation.

The Challenge of Implementation

He said the rewritten Income Tax Act, coming into force on April 1, focuses on clarity and simplicity, with rules and forms designed to make compliance easier through technology. "The challenge now is delivery," Shrivastava said, adding that feedback from industry would be critical to ensure effective implementation. (ANI)

(Except for the headline, this story has not been edited by Asianet Newsable English staff and is published from a syndicated feed.)