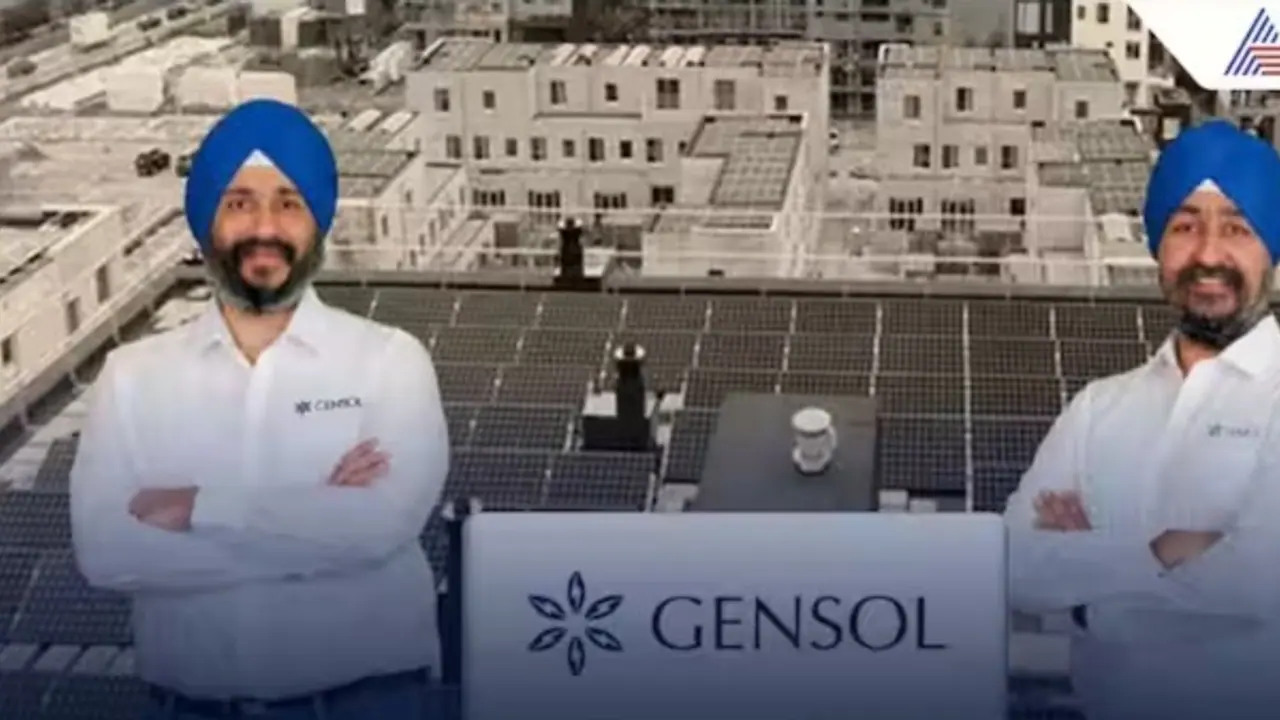

Gensol-BluSmart founders, Anmol and Puneet Jaggi, are embroiled in a financial fraud scandal. A SEBI report reveals misappropriation of funds meant for business development, used for personal gains.

Once hailed a rising star in the green tech sector, Gensol-BluSmart founders Anmol Singh Jaggi and Puneet Singh Jaggi, have now been accused of orchestrating a multi-crore scandal that has shaken investor confidence.

According to Securities and Exchange Board of India (SEBI)'s damning 29-page interim report, the Jaggi brothers indulged in systematic financial misappropriation, siphoning off hundreds of crores from company coffers for personal luxuries and speculative market manipulation.

From forging ‘no default’ certificates purportedly issued by lenders such as IREDA and PFC to mislead regulators, to rerouting sanctioned loans for lavish personal use.

Where did EV funds go?

The investigation unearthed that the duo channelled company funds to purchase a luxury flat in The Camellias, an ultra-exclusive residential enclave in Gurugram. The Rs 43-crore apartment, initially booked in their mother’s name, was later transferred to Capbridge Ventures, a firm owned by the brothers. SEBI also found that Rs 775 crore was funnelled to Go-Auto, a dealership used to acquire electric vehicles for BluSmart, a ride-hailing company.

Of this, only Rs 570 crore was used for the stated purpose; the remaining Rs 205 crore, including the flat payment, was siphoned off for unrelated ventures.

The lavish indulgences didn’t stop at real estate. The report reveals appalling expenditures: Rs 26 lakh on golf sets, Rs 23 lakh to settle credit card bills, and Rs 8 lakh on plush interior décor—all funded through the misused loans.

The promoters deployed a Gensol subsidiary, Wellray, to engineer a fictitious market for Gensol’s shares. Over two-and-a-half years till December 2024, Wellray accounted for nearly 99% of the stock’s total trading volume, fabricating demand and inflating the stock price.

SEBI minced no words in its condemnation. “What we are witnessing is not just financial mismanagement – it’s a full-scale betrayal of public trust,” the regulator remarked in its order. “Promoters were running the company like a personal piggy bank.”

The gravity of the scandal has now led SEBI to impose an immediate ban on Anmol and Puneet Singh Jaggi from accessing the securities market. A forensic audit has also been ordered to trace the full extent of the malfeasance. With the potential for significant write-offs in Gensol’s accounts, the brunt of this corporate debacle may ultimately fall upon unsuspecting investors.